To trade commodities successfully traders ought to start by learning the basics of commodity trading. Trading commodities is really commodities futures trading. Producers and processors of commodities buy and sell futures contracts for delivery on a specific date during any of the next months or years. Producers and processors are typically hedging their investment risk and helping to provide a stable market for the commodity in question. Speculators can trade the same commodity futures contracts by buying and selling futures or they can buy options and sell options on futures contracts. Commodity and futures training is a good place to start learning the basics of commodity trading. For those interested options trading in commodities markets, Options Training with Stephen Bigalow will provide basic knowledge as well as the deeper insight gained from experience trading options in commodity futures.

Commodity futures as an asset class differ from stocks or long term bonds. A standard futures contract for corn futures, oil futures, or gold futures is a claim or a promise relating to a standardized quantity of a tangible asset. The claim for delivery or promise to deliver is on the contract expiration date. As a matter of fact, traders seldom hold a contract through to expiration but rather execute the opposite trade on the same commodity and expiration date in order to exit the trade. Because a futures contract has an expiration date it is not a claim upon the assets of a corporation. Supply and demand often cause pronounced commodity price shifts. Agricultural commodities are especially prone to large fluctuations in price as variation in weather conditions and amounts of crops planted or cattle culled from herds affect supply. The basics of commodity trading are that a trader in commodities is not concerned with competence of management, a margin of safety, or diversifying a stock portfolio into various market sectors. He or she is concerned with drought in Argentina or Russia, the opening of markets in Asia, or, in the case of gold, the seemingly continual devaluation of the US dollar.

The basics of commodity trading are that some commodities can be stored, like gold, oil, and corn. Some commodities, such as milk, have a short shelf life. Knowing the basics of commodity trading for a given set of commodities is essential for trading them. Traders should know that the decisions of large producers and buyers of commodities typically drive the markets in various commodities. Therefore, not all fluctuation in commodity prices is based upon the fundamentals of production and demand. It is also based on anticipation of market factors by large buyers and sellers. Thus, successful commodities trading requires the ability to anticipate the actions of other traders, the commodities market. Using technical analysis tools such as Candlestick chart patterns helps the trader see where the market is going. This is because trading patterns in commodity prices tend to repeat themselves. Knowing the basic Candlestick analysis patterns helps the smart trader with useful knowledge to successfully trade and profit from trading commodities.

Market Direction

What is the most important indicator when analyzing candlesticks signals? There are numerous confirming indicators that improve the effectiveness of candlestick signals. Stochastics play an important role for adding credence to the candlestick signals. Major moving averages demonstrate good support or resistance potentials. The T-line demonstrates whether a trend is going to continue or possibly reverse. However, the most important aspect when using candlestick analysis is the signals themselves.

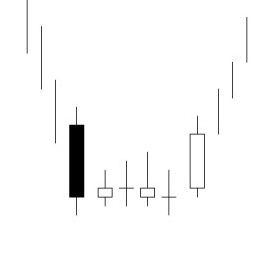

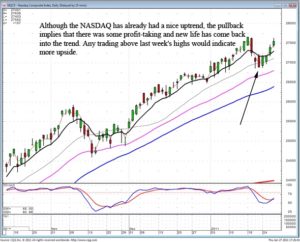

This was clearly demonstrated today in both the Dow and the NASDAQ. Yesterday both indexes closed just at the T-line. However, each had formed an indecisive Spinning Top formation. Both the Dow and the NASDAQ had stochastics showing oversold conditions. This would have suggested there was going to be more upside movement. The accuracy of trend analysis is greatly enhanced by knowing what each individual signal represents. Also, there are a few basic rules that can be applied to each signal.

DOW

Although the stochastics were in the oversold condition, starting to curl up, knowing what should occur after specific signals made today’s trading relatively simple. The trend/price is going to move in the direction of how prices open after a Doji/spinning top. When the premarket futures were slightly soggy and the markets immediately started selling off, this produced immediate information. The Bulls were not yet able to take the market up through the T-line. How was this information useful?

A weaker open after a Spinning Top, right at the T-line, would have made any buying of long positions today not be executed until prices showed bullish strength. The weak open provided the prospect that the tee line was still acting as resistance. The uptrend had to be confirmed with a candlestick buy signal, which both indexes demonstrated a few days ago, and a close above the T-line. The weaker open today should have delayed any long position buying and instigated closing any long positions that were showing weakness or also not able to break through the T-line.

This is not sophisticated trend analysis. The visual aspects of candlestick signals and the simple rules that are associated with them provide a common sense trading format. There are many if/then trading rules that illustrate what reoccurring investor sentiment is doing. Those thought processes are very consistent.

The effectiveness of reoccurring patterns provides huge profit potential in all trading entities. As illustrated in the October Live Cattle chart, the uptrend contained a number of pullbacks. Each time the price pulled back, it could be observed the formations each day showed indecisive selling. This is a common indication the uptrend is just resting.

Dec Live Cattle

Obviously, knowing when high probability buy setups occur, profits for the account can build up extremely fast. Having the ability to accurately analyze which direction the daily price chart will move allows for very profitable intraday trading. Knowing the daily bias is up, a trader can take advantage of the profit-taking during the day and buy back when the intraday buy signals occur. Once again, this is not sophisticated analysis. This is merely understanding the common sense information built into candlestick signals.

Chat session tonight at 8 PM ET — Everybody is welcome. Tonight we will discuss how to fine tune your trend analysis capabilities.

Good Investing,

The Candlestick Forum Team