To successfully trade commodities, traders learn the basics of commodity trading with classes like Commodity and Futures Training. As part of a successful trading strategy for commodities, traders follow commodity news reports. There are many places to find commodity news reports. These include print media such as the Wall Street Journal, the online business news media such as Bloomberg, Yahoo Finance, Google News, and the like, and propriety news media affiliated with commodity dealers and commodity brokers. Much of what comprises news about commodities comes from following trading on the NYMEX or official reports such as the US Department of Agriculture Daily National Grain Market Summary. Commodity news reports ideally contain hard data first of all and reasoned analysis second. The hard data of commodity news reports can be used for fundamental analysis of the commodity in question. Opinions of commodities analysts may be useful in directing the trader where to focus his or her technical analysis of commodities markets.

The type of information in commodity news reports typically has to do with issues of commodity supply and demand. Useful analysis will be that which gives insight into supply and demand issues. For example, a drought in Europe and Asia is drastically reducing wheat production and driving up prices worldwide. The fact that the drought is continuing towards the fall tells us that the winter wheat crop to be planted this fall will also be affected. Thus, even if there is snow this winter in the Russian Steppes and good spring rains the wheat crop will still be poor next year. The next set of facts a trader will want to see is reports of how much wheat is planted in the Dakotas, Nebraska, Kansas, Manitoba, and so forth, this coming fall. Fundamental commodity analysis starts with commodity news reports.

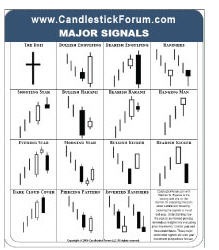

The timing of fundamental information about commodities from commodity news reports is important. To the extent that a trader gets the news first he can trade the news. For example, news of strikes in gold mines in South Africa will affect gold futures. Those who catch the news first will typically be able to successfully trade a jump in the price of gold futures. Even those who don’t get in on the news early and can’t trade the initial price jump will need to know what made the market change in order to successfully read subsequent gold commodity price movement and commodity price reversals. Even though successful technical traders know that eventually all fundamental information is factored into commodity prices the more they understand what is driving the market the more successfully they can trade. Rice traders in ancient Japan knew about the factors that influenced the price of rice. It was the addition of Candlestick analysis and Candlestick trading tactics on top of a fundamental understanding of the market that led to profits.

It is important for a commodity trader to understand commodity news reports, both what is written and what is left out. To the extent that a commodity broker is trying to gain customers there may be a slant to their reports. The ability of a trader to do their own fundamental and technical analysis will be protection against bad trading advice. Traders who follow the news, learn how to recognize a Candlestick pattern and follow Candlestick pattern formations will typically prosper more so than others because of their critical thinking and diligent attention to detail.

Market Direction

The market is in a downtrend but it opens positive and starts trading positive, what do you do? Without the combination of candlestick signals and confirming indicators, many investors would immediately reversed their positions. They may cover their shorts and buy long positions. As seen in today’s trading, that was not the correct thing to do. As a candlestick investor, the trend analysis becomes much easier to evaluate. The simple confirming indicators applied to candlestick analysis will help investors from being whipsawed.

Both the Dow and the NASDAQ opened positive today and started trading positive. However, some very simple analytical tools would have kept the candlestick investor from moving too rapidly. Although prices were moving up, the overall trend analysis still had some indicators that needed to be breached to indicate a trend reversal had occurred. The Dow chart shows the stochastics had come up out of the oversold condition and were heading back down. The downward trajectory was an indication the downtrend had not completed yet. Also, the most compelling confirming indicators had not been breached. A true reversal of a trend requires a close above the tee line.

DOW

It is understanding how all the indicators work in conjunction with candlestick signals that keeps an investor from being constantly whipsawed. This is a very important aspect of investing. Having patience and allowing proven indicator confirmation to become established. The lack of confirmation will keep the profitability moving in the right direction.

Should there be any buying in this market? On an overall basis, the answer should be no. However, there are chart patterns that reveal strong bullish price trend potential in spite of what the overall market is doing. Our recommendation of MELA illustrates how to utilize the proper signals and patterns. Note how the Scoop pattern is set up with gap up Doji’s. Also, a double bottom is apparent. The gap up in price over the past two trading days clearly illustrates investors aggressively wanting to get into a stock position.

MELA

These simple visual analytical techniques allows investors to be in the right positions at the correct times. This is not sophisticated analysis. This is merely taking advantage of the information built into candlestick signals. The Japanese Rice traders identified the power moves. Once you have learned how to use this visual analysis to your benefit, you put the probabilities of being in the right positions constantly in your favor.

Chat session tonight at 8 PM — members only

Good Investing,

The Candlestick Forum Team

Ultimate Candlestick Training Package – ON SALE!!!