An investor looking for a stock market home study course is looking for investment training that is simple to understand and easy to implement. Many a stock market home study course does not fulfill that criterion. Investors do not have a firm grip on the information being conveyed. Further expensive training courses are required. A stock market home study course that is simple to understand is the training course for learning candlestick signals. Candlestick signals provide one very simple element. They are visually easy to recognize. The main facet for a stock market home study course should be being able to implement the investment training to successful investing without a multitude of additional courses. Candlestick signals and candlestick analysis utilizes common sense investment practices put into a graphic depiction.

The Japanese Rice traders have produced a number of reversal signals that have proven themselves successful over the past for centuries. The results of the signals are statistically proven. Not by computer back testing, but with actual profitable results through the centuries. A stock market home study course should provide a proven trading program that is not still in the experimentation process. Candlestick signals provide investors with a very clear visual format for when a price reversal is occurring. Utilizing this information becomes a simple visual analysis.

Another element of a stock market home study course should be its application in all market conditions. Candlestick analysis not only provides a trading method for finding individual stocks, it provides an analysis process for projecting the directions on the markets. The information conveyed through the proper use of candlestick signals produces a training platform that allows an investor to exploit profits from all market conditions. The value of any stock market home study course is directly related to the effectiveness of the information provided. Candlestick signals provide high probability investment situations. Learn how to use the signals correctly and you will understand how the professional investors think. You’ll be able to exploit profits from the reoccurring emotional trading where most investors lose money.

There are 12 major candlestick signals. Learning those signals well will provide more investment knowledge than most investors will understand in their lifetimes. The remaining candlestick signals are not so important that they need to have a lot of time and effort spent on learning what they mean. However, being able to recognize the signals allows an investor to come back to a reference and get more information on what that signal is conveying. The Two Crows Pattern is part of our trading articles for Candlestick Secondary Signals. While these signals are considered ‘secondary’ it does not negate the effectiveness of their strong trading potential. They are called ‘secondary’ because they do not appear as frequently as The Major Candlestick Signals.

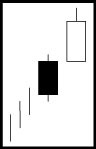

TWO CROWS PATTERN

Description

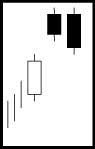

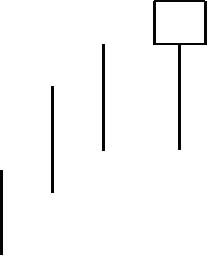

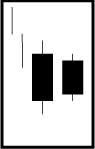

The Two Crows Pattern is a 3-day pattern. It is only a top-reversal pattern. Like the Upside Gap, the Two Crows is a gap pattern, created between the long white candle at the top of an uptrend and the small balck candle at the second day. The black candles gaps open and pulls back before the end of the day. Even though it has pulled back, it did not fill the gap. The third day opens in the body of the small black candle. The Bears maintain the control and move it lower. They are able to fill the gap and close the price within the white candle body. The gap being filled so quickly eliminates any expectations from the bulls.

Criteria

- A long white candle continues the uptrend.

- The real body of the next day is black while gapping up and not filling the gap.

- The third day opens within the second day’s body and closes within the white candle’s body. This produces a black candle that filled in the gap.

Signal Enhancements

- If the third day were to close more than halfway down the white candle, it would form an Evening Star Pattern.

Pattern Psychology

After a strong uptrend has been in effect, the atmosphere is bullish. The price gap opens but cannot hold the gains. Before the end of the day, the bears step in and take the price back down. However, the gap up from the white candle was not filled. The next day, the price opens slightly higher, within the body of the previous black candle. The bulls aren’t as boisterous and cannot keep the momentum going. Prices head lower and closes in the white candle range. The gap up from the bullish exuberance of the previous day is very quickly wiped away. The further the third day closes into the white candle body, the more bearish the implications.