![]()

Stock Market Holiday Calendars and FREE E-BOOK

12 SIGNALS TO MASTER ANY MARKET

WHEN YOU SIGN UP FOR OUR NEWSLETTER

| 2018 Stock Market Holidays | Date |

| New Year’s Day | January 1, 2018 |

| Martin Luther King, Jr. Day | January 15, 2018 |

| Washington’s Birthday/Presidents’ Day | Febuary 19, 2018 |

| Good Friday | March 30, 2018 |

| Memorial Day | May 28, 2018 |

| Independence Day | July 4, 2018 |

| Labor Day | September 3, 2018 |

| Thanksgiving Day** | November 22, 2018 |

| Christmas | December 25, 2018 |

| **The NYSE Trading Floor closes early (1PM ET) on Friday the day after Thanksgiving |

Remember, the professional money managers often vacation around scheduled exchange holidays.

They may also close positions several days before, causing lighter volume around the stock market holidays.

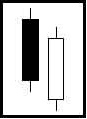

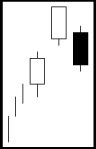

As illustrated, a stock price closing higher than where it opened will produce a white candle. A stock price closing lower than where it opened creates a black candle. The boxes formed are called “the body”. The extremes of the daily price movement, represented by lines extending from the body, are called “shadows or tails.”

As illustrated, a stock price closing higher than where it opened will produce a white candle. A stock price closing lower than where it opened creates a black candle. The boxes formed are called “the body”. The extremes of the daily price movement, represented by lines extending from the body, are called “shadows or tails.”