A commodity trading course is not needed when utilizing candlestick signals. What can be taught in a commodity trading course? An investor only needs to understand what makes commodity prices move up or down. Candlestick signals clearly demonstrate when prices are going higher, or going lower. A commodity trading course can not provide a platform for analyzing what prices are going to do. What makes commodity prices move? Supply and demand! A commodity trading course will not be able to produce the insights to trade successfully. Candlestick signals produce the format for detecting changes in investor sentiment.

Where do investors learn how to trade commodities? There is not a commodity trading course available in institutions of higher learning. An investor needs a platform for detecting when to buy and when to sell. The Japanese Rice traders developed the most basic and accurate method for producing high profits in commodity trading. They traded the most basic of commodities, Rice. The information that is conveyed in a candlestick signal is much more important than trying to analyze the fundamental conditions of a commodity price. The big money, ‘smart money,’ can be seen establishing their positions based upon what the candlestick signal formations reveal.

Utilize the simple information that is conveyed in a candlestick signal. Each signal has been analyzed for hundreds of years. Not only does that analysis include visual recognition of a reversal in a commodity price trend, the Japanese Rice traders were able to evaluate what the investor sentiment was doing to create the reversal signal. Learn to use the candlestick signals correctly and understand the information that each signal provides and you will have a huge investment advantage. This is not difficult analysis. Each candlestick signal illustrates what investors were thinking at important reversal points. When this knowledge can be seen in a graphic formation, the probabilities of being in the correct trade at the correct time increases dramatically.

This week’s featured Candlestick Pattern –

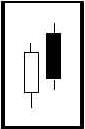

The Breakaway Pattern

Description

If a trend has been evident, the breakaway pattern, whether bullish or bearish initially indicates the acceleration of that trend. The pattern starts with a long candle representing the current trend. The next candle gaps away from the long candle with the color of that candle the same as the long candle. The third day can be either color. It will not show a change in the trend. The fourth day continues the trend, having the same color as the trend. The fifth day reverses the trend. It opens slightly opposite of the way the trend has been running. From there, it continues in the same direction to where it closes in the gap area.

Criteria

- The first day is a long-body day has the color of the existing trend.

- The second day gaps away from the previous close. It has the same color as the first day candle.

- Day three and four have closes that continue the trend.

- The last day is an opposite color day that closes in the gap area between day one and day two.

Pattern Psychology

After a trend, usually in an overbought or oversold area, a long candle forms. The next day they gap the price further. That day has the same color as the trend. For the next two days, the bulls and/or bears keep the trend going in the same direction, but with less conviction. The final day, the move goes opposite the existing trend with enough force to close in the gap area between day one and day two. This day completely erases the move of the previous three days.