Utilizing Candlestick signals can help an investor develop a highly profitable commodity trading system. Japanese rice traders used the signals to develop the first commodity trading system. The Honshu family successfully traded the rice markets centuries ago.

Commodities are easier to trade than stocks using Candlestick signals. The reason is simple. There are fewer outside influences to affect commodity prices. A successful commodity trading system can be implemented through simple visual analysis.

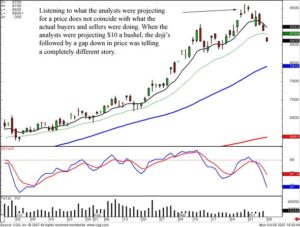

The signals used in conjunction with simple confirming indicators such as stochastics produce a high probability commodity trading system. As illustrated in the July Wheat chart, when the price of Wheat was an oversold condition, a Bullish Harami illustrated the time to buy.

The trend of a commodity will usually remain steady in one direction until the stochastics indicate an extreme condition, either overbought or oversold. Applying Candlestick signals to the trend analysis in these extreme conditions makes for a very simple commodity trading system. The probabilities become highly in the favor of the Candlestick investor.

Note how July Wheat started its uptrend when the stochastics were in the oversold condition. A Bullish Harami/Spinning Top was the reversal signal at the bottom. July Wheat now is approaching the overbought area. The indecision, Spinning Tops and Doji’s, indicate less conviction to the upside. A Bearish Engulfing signal today should signify that the uptrend.

Wheat

The Candlestick signals make for a high profit commodity trading system because of the immense amount of investment information provided in each of the signals. Prices move based on investor sentiment. Use this information to your advantage. The 12 major signals can make trading commodities extremely profitable.

Commodity Trading Platforms

Commodity trading platforms are a necessity. The extreme leverage used in commodity trading definitely requires a basis for buying and selling. One of the most proven commodity trading platforms is Candlestick signals. Candlestick analysis was developed through hundreds of years of trading rice.

The 12 major signals that are very effective for trading stocks become more effective when trading commodities. Commodity trends have one basic advantage over stock trends. Once a commodity trend is identified, the trend will persist in much better identifiable moves than a stock price. The reason for this is that commodities usually have much fewer outside influences than a stock price. A commodity price usually moves based on supply and demand. A stock price will move based on changes in fundamental elements, the stock market direction in general, interest rate moves, or a multitude of other influences that can change investor sentiment.

Being able to identify strong reversal patterns using Candlestick signals is one of the best commodity trading platforms available. Commodities usually move based on supply and demand. Those influences have a minimal number of aspects. Grains and the soft commodities can be affected by weather. Currencies can be affected by each other. The dollar will usually act inversely to the British pound, the Eurodollar, and the Swiss franc.

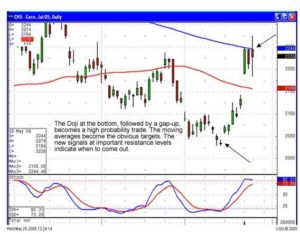

Highly profitable commodity trading platforms can be developed when you have Candlestick signals illustrating definite reversals in trends. As illustrated in the July Corn contract, a Doji at the bottom followed by a gap-up, when stochastics were in the oversold condition, made for a high probability, profitable trade. Being able to identify the obvious reversal signals allows the Candlestick investor to take advantage of entering trades at the optimal prices.

Corn

The centuries of identifying high profit reversal signals are built into Candlestick formations. Use this information to your advantage. Whether trading stocks or commodities, the signals put the probabilities highly in the investor’s favor. Very simple and profitable commodity trading platforms can be established. If you find a trading format that works successfully, then it is better to use it on a trading entity where you can leverage your high probability success ratio.

Speak Your Mind