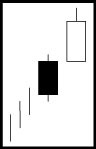

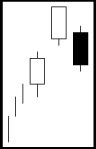

Most Candlestick signals are reversal patterns; however, there are periods of trends that represent rest. The Japanese insight is, “there are times to buy, times to sell, and times to rest.” Once a pattern is recognized, it is suggesting a direction for future price movements. Continuation patterns found in candlestick charting help with the decision-making process. Whatever the pattern, a decision has to be made–even if the decision is to do nothing.

Learning the continuation patterns found in candlestick charting has important features. In some cases, differences between reversal patterns and the continuation of a trend can be subtle. Candlestick Charting provides the knowledge of how minor price variations can affect the direction of a trend can lead to enhancements of profits. As the candlestick charts are studied, recognizing the differences will greatly alter investment strategies.

For easier reference, continuation patterns found in candlestick charts have a section of their own. Each week we will select a continuation pattern and break it down into detail with the description, pattern criteria, and pattern psychology from the list below.

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Pattern Description with criteria and Pattern Psychology

Speak Your Mind