The Major Signals

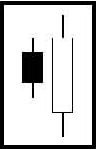

Doji

DOJI Recognition: The open and close are the same or very close to the same.

Pattern Psychology: The Bulls and the Bears are conflicting. This is an alert to investors to take heed for possible trend reversal.

Related Articles: How To Trade the Doji Signal, The Dynamic Doji

Training Tutorial: Dynamic Doji

View Current Charts & Lists of Stocks for Doji Stock Screens

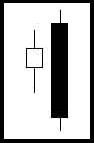

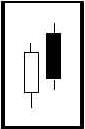

Bullish Engulfing

BULLISH ENGULFING Recognition: The body of the second day completely engulfs the body of the first day. Shadows are not a consideration.

Pattern Psychology: This pattern suggests the Bulls are stepping in with force, suggesting prices will move up.

Related Articles: How to Trade the Bullish Engulfing Signal, Candlestick Engulfing Patterns

Training Tutorial: Bullish Engulfing

View Current Charts & Lists of Stocks for Bullish Engulfing Stock Screens

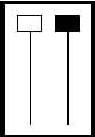

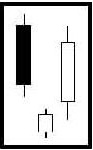

Bearish Engulfing

BEARISH ENGULFING Recognition: The body of the second day completely engulfs the body of the first day. Shadows are not a consideration.

Pattern Psychology: This shows the Bears are overwhelming the Bulls, suggesting prices will move down.

Related Articles: How to Trade the Bearish Engulfing Signal, Candlestick Engulfing Patterns

Training Tutorial: Bearish Engulfing

Hammers and Hanging Man

HAMMERS and HANGING-MAN

Recognition: The lower shadow (or tail) should be at least two times the length of the body. The color of the body is not important although a black body has slightly more Bearish indications and a white body has slightly more Bullish indications.

Pattern Psychology: This pattern at the bottom of a down trend is called a Hammer. This pattern at the top of an uptrend is called a Hanging-Man

Related Articles: How to Trade The Hammer Signal, How to Trade the Hanging Man

Training Tutorials: Hammer, Inverted Hammer, Hanging Man

Piercing Pattern

PIERCING PATTERN Recognition: A two candle pattern, the body of the first candle is black and the body of the second candle is white. The white day opens lower, under the trading range of the previous day. The price closes above the 50% level of the black body.

Pattern Psychology: After a strong downtrend, the atmosphere is Bearish but before the end of the day the Bulls step in and price closes near the high of the day.

Related Articles: How to Trade the Piercing Pattern

Training Tutorial: Piercing Pattern

Dark Cloud

DARK CLOUD Recognition: A two candle pattern, the body of the first candle is white and the body of the second candle is black. The black day opens higher, above the trading range of the previous day. The price closes below the 50% level of the white body.

Pattern Psychology: After a strong uptrend, the atmosphere is Bullish but before the end of the day the Bears step in and price closes near the low of the day.

Related Articles: Stock Trading Methods, How to Trade the Dark Cloud Signal

Training Tutorial: Dark Cloud Cover

Bullish Harami

BULLISH HARAMI Recognition: A two candle pattern forming in a down trending price pattern. The body of the first candle is the same color as the current trend and should be a long black candle. The body of the second candle is white and opens and closes within the body of previous day’s candle.

Pattern Psychology: After a strong downtrend the Bulls step in and open the price higher than the previous day’s close. This concerns the Bears and the shorts start covering their positions. A strong day after that would convince everybody that the trend may be in a reversal.

Related Articles: How to Trade the Bullish Harami, The Harami – A High Profit Candlestick Signal

Training Tutorial – Harami Pattern

Bearish Harami

BEARISH HARAMI Recognition: A two candle pattern forming in an up trending price pattern. The body of the first candle is the same color as the current trend and should be a long white candle. The body of the second candle is black and opens and closes within the body of the previous day’s candle.

Pattern Psychology: After a strong uptrend the Bears step in and open the price lower than the previous day’s close. The price finishes lower for the day and the Bulls are concerned and begin taking their profits.

Related Articles: How to Trade The Bearish Harami The Harami – A High Profit Candlestick Signal

Training Tutorial: Harami Pattern

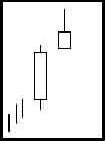

Morning Star

MORNING STAR Recognition: A three candle pattern at the bottom of a downtrend.The body of the first candle is black, confirming the current downtrend. The second candle is an indecisive formation. The third candle is white and should close at least halfway up the black candle.

Pattern Psychology: After an apparent downtrend the Bulls step in and open the price higher than the previous day’s close. The price finishes higher for the day and the Bears are concerned and begin covering their short positions.

Related Articles: How to Trade the Morning Star Signal, Morning Star Reversal Signal

Training Tutorial: Morning Star & Evening Star Signals

Evening Star

EVENING STAR Recognition: A three candle pattern at the top of an uptrend. The body of the first candle is white, confirming the current uptrend. The second candle is an indecisive formation. The third candle is black and should close at least halfway down the white candle.

Pattern Psychology: After an apparent uptrend the Bears step in and open the price lower than the previous day’s open. The price finishes lower for the day and the Bulls are concerned and begin selling to take their profits.

Related Articles: How to Trade the Evening Star Signal Swing Trading with an Evening Star Signal

Training Tutorial: Morning Star & Evening Star Signals

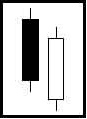

Kicker Signals

Kicker Signals Bearish and Bullish Recognition: The first day’s open and the second day’s open are the same BUT the price movement is in opposite directions.

Pattern Psychology: The Kicker Signal demonstrates a dramatic change in investor sentiment. The longer the candles, the more dramatic the price reversal.

Related Articles: What is the Strongest Candlestick Signal – The Kicker!, Technical Analysis that Produces Big Profits

Training Tutorial: Kicker Signals

Shooting Star

SHOOTING STAR Recognition: One candle pattern appearing in an uptrend. The shadow (or tail) should be at least two times the length of the body. The color of the body is not important, although a black body has slightly more Bearish indications.

Pattern Psychology: After a strong uptrend the Bulls appear to still be in control with price opening higher, but by the end of the day the Bears step in and take the price back down to the lower end of the trading range. Lower trading the next day reinforces the probability of a pullback.

Related Articles: How to Trade the Shooting Star Signal

Training Tutorial: The Shooting Star

Inverted Hammer

INVERTED HAMMER Recognition: The upper shadow should be at least two times the length of the body. The real body is at the lower end of the trading range. There should be no lower shadow or a very small lower shadow.

Pattern Psychology: After a downtrend has been in effect, the atmosphere is Bearish. The price opens and trades lower but before the end of the day, The Bulls step in and take the price back up. A higher open or a white candle the next day reinforces buying.

Related Articles: Technical Analysis Simplified, How to Trade the Inverted Hammer

Training Tutorial: The Inverted Hammer

Speak Your Mind