Stock market advice is plentiful over the internet. There is sage stock market advice like; Don’t try to time the market, use cost averaging, diversify, and limitless tid-bits but they do not teach you anything about trading. What good is stock market advice if you still don’t know how to read a stock chart? The Candlestick Forum provides practical stock market advice by continued “How To Trade” articles for identifying specific candlestick charts. This article will help you to identify The Morning Star signal and the trading criteria used for successful implementation. We hope these articles are helping you along your way to successful stock market trading. Be sure to join Stephen Bigalow live over the internet for his free Thursday evening Chat Sessions.

MORNING STAR

Description

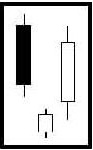

The Morning Star is a bottom reversal signal. Like the planet Mercury, the morning star, it foretells that brighter things – sunrise, is about to occur, or that prices are going to go higher. It is formed after an obvious downtrend. It is made by a long black body, usually one of the fear-induces days at the bottom of a long decline. The following day gaps down. However, the magnitude of the trading range remains small for the day. This is the star of the formation. The third day is a white candle day. And represents the fact that the bulls have now stepped in and seized control. The optimal Morning Star signal would have a gap before and after the star day.

The make up of the star, an indecision formation, can consist of a number of candle formations. The important factor is to witness the confirmation of the bulls taking over the next day. That candle should consist of a closing that is at least halfway up the black candle of two days prior.

Criteria

- The downtrend has been apparent.

- The body of the first candle is black, continuing the current trend. The second candle is an indecision formation.

- The third day shows evidence that the bulls have stepped in. That candle should close at least halfway up the black candle.

Signal Enhancements

- The longer the black candle and the white candle, the more forceful the reversal.

- The more indecision that the star day illustrates, the better probabilities that a reversal will occur.

- A Gap between the first day and the second day adds to the probability that a reversal is occurring.

- A gap before and after the star day is even more desirable.

- The magnitude, that the third day comes up into the black candle of the first day, indicates the strength of the reversal.

Pattern Psychology

A strong downtrend has been in effect. The sellers start getting panicky. There is a large sell-off day. The next day as the selling continues, bulls are stepping in at the low prices. If there is big volume during these days, it shows that the ownership has dramatically changed hands. The second day does not have a large trading range. The third day the bears start to lose conviction as the bull increase their buying. When the price starts moving back into the trading range of the first day, the sellers diminish and the buyers seize control.

Training Tutorial

The Morning Star & Evening Star Signals This 56 minute video provides a clear understanding for trading and maximizing your profits.

Speak Your Mind