Most investors get confused with the massive amounts of stock market data. Especially for new investors, trying to decipher which stock market data is the most important is an impossible hurdle. Candlestick signals dramatically reduce the time for importing important stock market data. The information built into the signals is the accumulation of observations from Japanese Rice traders over the centuries. How do you know which stock market data is pertinent? The information that is used consistently for centuries is an obvious clue. The 12 major candlestick signals make for very high probability research. The information conveyed in each major signal has viable results.

What becomes the most important element when utilizing stock market data? The results the information has produced in the past. Understanding how to evaluate what each of the major candlestick signals reveals is very important. The Bearish Engulfing signal is one of the 12 major signals. It provides a very clear representation of what is going on in investor sentiment. Where most stock market data is numeric, the candlestick signals provide that same information in a graphic form. Most stock market data requires evaluation. This evaluation often involves complicated formulas. The candlestick signals are very basic visual analytical tools. The Bearish Engulfing signal visually illustrates that there has been a dramatic change in investor sentiment. Candlesticks were developed specifically to add more information to chart analysis.

A simple description of the Bearish Engulfing signal reveals why the signal works very well as a candlestick sell signal. This is the stock market data that an investor should be using for both technical analysis as well as fundamental analysis. The information conveyed in this signal creates an extremely high probability that the buying is over. It also reveals an opportunity for establishing a good short position.

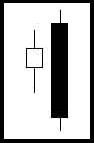

Bearish Engulfing Pattern

Description

The Bearish Engulfing pattern is a major reversal pattern comprised of two opposite colored bodies. The Bearish Engulfing Pattern is formed after an up trend. It opens higher than the previous day’s close and closes lower than the previous day’s open. Thus, the black candle completely engulfs the previous day’s white candle. Engulfing can include either the open or the close be equal to the open or close of the previous day, but not both.

Criteria

- The body of the second day completely engulfs the body of the first day. Shadows are not a consideration.

- Prices have been in a definable uptrend, even if it has been short term.

- The body of the second candle is opposite color of the first candle, the first candle being the color of the previous trend. The exception to this rule is when the engulfed body is a Doji or an extremely small body.

Signal Enhancements

- A large body engulfing a small body. The previous day was showing the trend was running out of steam. The large body shows that the new direction has started with good force.

- When the engulfing pattern occurs after a fast spike up, there will be less supply of stock to slow down the reversal move. A fast move makes a stock price over-extended and increases the potential for profit taking and a meaningful pullback.

- Large volume on the engulfing day increases the chances that a blow off day has occurred.

- The engulfing body engulfing more than one previous body demonstrates power in the reversal.

- If the engulfing body engulfs the body and the shadows of the previous day, the reversal has a greater probability of working.

- The greater the open gaps up from the previous close, the greater the probability of a strong reversal.

Pattern Psychology

After an uptrend has been in effect, the price opens higher than where it closed the previous day. Before the end of the day, the sellers have taken over and moved the price below where it opened the day before. The emotional psychology of the trend has now been reversed.

Whether day trading, swing trading, or long-term investing, the major signals work effectively in any time frame. Candlestick charts become a very fast and easy analysis of what is going on in a price trend. The same analysis can be done on market indexes, sectors/industries, or individual stocks or commodities. Candlestick charts have recently come into vogue. Over the past decade, the years of candlestick charts has exploded. Unfortunately, most investors do not know how to use them correctly. Learn the major signals and you’ll have control over your own financial future.

Stock market data is useless if it is not interpreted correctly. Candlestick stock charts allow an investor to evaluate a trend almost instantly. When learning the stock market, use an investment technique that is well proven. Candlestick analysis fits that description.

Speak Your Mind