Stock market investing 101 should include as easy a process to learn the stock market as possible. Candlestick signals incorporating common sense investment practices meet those criteria. Stock market investing 101 is a process that should allow investors to understand why prices move. The psychology incorporated into candlestick signals makes understanding what is going on in an investor’s mind very easy to analyze. The signals were created through hundreds of years of visual analysis and interpretation by successful Japanese Rice traders.

Most stock market investing 101 courses want to include fundamental reasons for why prices move. MBA’s graduate every year with the concept if you can read a strong balance sheet, the price will move. One of the biggest misconception of investing is anticipating prices to move based upon fundamental reasons. The first lesson of stock market investing 101 should be that prices move based upon the “perception” of fundamental reasons. The Japanese Rice traders discovered this many centuries ago. Why do prices go down when good news is announced? Because the anticipation of that good news was already built into the stock price.

Candlestick signals are formed based upon the investor sentiment that indicates a change. Use this information to your advantage. You may not have a research staff or access to extensive research, but you can take advantage of the information conveyed in candlestick signals. Why do candlestick buy signals occur at the bottom? Because the smart money is anticipating what the future potential is for the price. That future potential may be good news. The prospect of favorable news is what makes the smart money buy when everybody else is selling. The announcement of the good news is what makes the smart money sell at the top when everybody else is buying. That information is conveyed through numerous candlestick signals.

Trading The Three Black Crows Pattern

Description

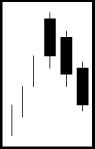

The Three Black Crows got their name from the resemblance of three crows looking down from their perch from a tree. The signal, occurring after a strong uptrend, indicates the crows looking down, or lower prices to come. This pattern is the opposite of the Three White Soldiers.

Criteria

- Three long black bodies occur, all of close to or equal length.

- The prior trend was up.

- Each day opens within the body of the previous day.

- Each day closes near its low.

Pattern Psychology

A long black candle forms after an uptrend. This uptrend has now reached levels where the sellers have started to step in. The first long black candle body is followed by two more long black candles. Each having opened in the previous day’s body, indicating that buying was occurring early each day but the Bears kept forcing prices down by the end of the day. This consistent process of selling provides a stronger downtrend potential versus a rapid overselling period.

Training Tutorial

Candlestickforum Flash Cards These unique Flash Cards will allow you to be “trading like the Pro’s” in no time.

Speak Your Mind