What is the strongest candlestick signal? The Kicker signal! It demonstrates a severe change an investor sentiment. A good rule of thumb is that if an investor sees a Kicker signal, he/she should go long or short depending on whether it is a Bullish Kicker or a Bearish Kicker.

And that is exactly what we saw happen today in the NASDAQ index. The Bearish Kicker signal, especially with the stochastics in the overbought area, indicates that we want to be out of our long positions, either sitting in cash or shorting the market.

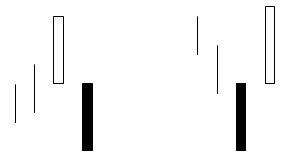

KICKER SIGNAL

( Keri Ashi )

Description

The Kicker signal is the most powerful signal of all. It works equally well in both directions. Its relevance is magnified when occurring in the overbought or oversold area. It is formed by two candles. The first candle opens and moves in the direction of the current trend. The second candle opens at the same open of the previous day, a gap open, and heads in the opposite direction of the previous day’s candle. The bodies of the candles are opposite colors. This formation is indicative of a dramatic change in investor sentiment. The candlesticks visually depict the magnitude of the change.

Criteria

- The first day’s open and the second day’s open are the same. The price movement is in opposite directions from the opening price.

- The trend has no relevance in a Kicker situation.

- The signal is usually formed by surprise news before or after market hours.

- The price never retraces into the previous day’s trading range.

Signal Enhancements

- The longer the candles, the more dramatic the price reversal.

- Opening from yesterday’s close to yesterday’s open already is a gap. However, gapping away from the previous day’s open further enhances the reversal.

Pattern Psychology

The Kicker signal demonstrates a dramatic change in the investor sentiment. Something has occurred to violently change the direction of the price. Usually a surprise news item is the cause of this type of move. The signal illustrates such a change in the current direction that the new direction will persist with strength for a good while.

There is one caveat to this signal. If the next day prices gap back the other way, liquidate the trade immediately. This does not happen very often, but when it does, get out immediately.

Speak Your Mind