Are you the type of person that wants to have all your questions answered immediately when trying to learn a new investment program? Wouldn’t you like to get instant explanations and recommendations when viewing a Candlestick chart or pattern, directly from Candlestick experts? Join TeleChart 2005 Platinum through the Candlestick Forum and chat with Steve Bigalow LIVE! Join Steve and fellow candlestick traders in the “Candlestick Forum” club on TeleChart 2005 Platinum. The Candlestick Forum, in association with TeleChart 2005, now provides the most direct, fast path method for becoming an expert in Candlestick investing.

Purchase of TeleChart 2005 is separate from the Candlestick Forum paid membership service. You will find Stephen Bigalow in the Candlestick Forum club hosted through TeleChart 2005 and listed in their Club Directory. This club is open to all TeleChart2005 users.

TeleChart 2005 Platinum users look for the Candlestick Forum in the Club Directory. Join Steve and other members in the “Candlestick Forum” club on TeleChart 2005 Platinum.

Club Name: Candlestick Forum

Every effective investor needs the right tools to make good market decisions. Cutting edge information, great price charts, sound investment advice…these are all critical components in developing a solid, money-making investment strategy. Now all these tools and much more have been brought together in one place!

The Candlestick Forum and TeleChart 2005 …The Ultimate Stock Market Information Network!

Combining cutting-edge information sharing and news with the quality charting and data service you’ve come to expect, TeleChart 2005 Platinum is really is your solution to market research. Plus—you can get my commentary and reports on key stocks without ever leaving the charting program!

Check out these amazing features in TeleChart 2005 Platinum:

· Streaming data…

Ø TeleChart 2005 Platinum service automatically includes streaming, real-time data and intraday charts. Because of TeleChart 2005 Platinum’s unique replicated servers and exclusive new AccuTick™ technology, you enjoy some of the most reliable and accurate Real Time data available. Plus—you can choose from a developing list of Real Time sort criteria applicable to the streaming data on intraday charts updated every 60 seconds…and we even pay your exchange fees!

· Real time alerts…

Ø TeleChart 2005 Platinum also allows you to send real time alerts to your e-mail or pager. You can be alerted of price changes or important developments for any number of stocks in the system.

Ø In TeleChart 2005 Platinum, you are automatically part of an investor group keenly interested in learning more about the Stock Market and in benefiting from the commentary from top analysts in today’s market. And, you will now have access to my notes and reports on stocks, broader market issues and trends and Japanese Candlestick chart interpretation.

Ø Plus: You can now chat live with the entire TeleChart 2005 Platinum customer base about any ticker symbol in the system! I’ll be leading guided chat events where we can discuss individual stocks or industries…and remember, it’s all without ever leaving your charts! Learning about Candlesticks is now even easier by having this direct access to the experts. Just imagine… having one of the world’s leading experts looking over your shoulder and acting as your mentor!

· Shared Notes…

Ø You can also publish your own notes to the TeleChart 2005 Platinum community. And, since your charts automatically attach to notes you get quick access and easy organization for this wealth of information.

· Live, continuous news feeds…

Ø You have immediate access to TeleChart 2005 Platinum’s high quality news and information service built right into the program! You can read the hottest news stories about any stock continuously throughout the day and in real time! Plus—you get the latest earnings reports and announcements every day.

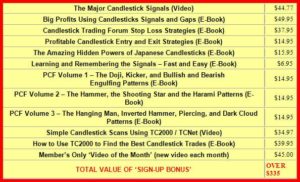

These great informational tools are built into the #1 charting service available. And all of this is automatically yours in your Candlestick Forum / TeleChart 2005 Platinum service. The most exciting thing for me—I can provide TeleChart 2005 Platinum for you at only $99.99 per month!

To sign up, simply click to go to the Worden Brothers Website to review enrollment options. TeleChart 2005 Platinum will get you signed up to the system and get you started. You’ll soon be finding out why I know The Candlestick Forum and TeleChart 2005 Platinum will soon become your definitive market research solution!