When things don’t go well in any sort of endeavor, time honored advice is typically to get back to the basics. Better advice in stock trading, options trading, or commodity trading is to stick to trading basics from the start and not need to “get back to” trading basics. So, what are trading basics? The basics of trading are to work from a plan and to work the plan. The plan in trading basics is a well thought out and frequently tested trading strategy. Successful trading requires a knowledge of the fundamentals for trading stocks, trading options, trading commodities such as gold futures and oil futures , or trading futures in such exotic entities as futures on interest rates. It also requires technical analysis tools such as Candlestick chart analysis in order to take advantage of a breakout gap, full scale stock price reversal, or to sell stock at the top of a trading cycle.

A good trading strategy includes taking the time to learn how to do and routinely carry out fundamental analysis. It includes learning how to do technical analysis with Candlestick analysis in order to anticipate and profitably trade changes in stock prices, commodity prices, or futures prices. Starting with the trading basics puts traders in the position to make money in trading. Carrying on with trading basics brings the trader closer to profitable trading. Besides learning the basics of fundamental and technical analysis the trader needs to learn and use the trading basics of using a trade station, making trades in a timely manner, and simply being there when the trading action starts.

The most important factor to success in trading is showing up. That sounds silly but it is the foundation of trading basics. The new trader will need to dedicate an amount of time to learning about market and what is traded. He will need to deep in touch with market news for stocks, bonds, options, and the rest. For the beginning trader who envisions successful trading as executing trades via clicks of a mouse trading basics will require that he learn how to devote a portion of his time to the homework necessary for successful trading. No matter what equity a trader is trading he will find that the market moves when the market decides to move. Traders profit from following the market, doing technical analysis, and executing timely trades. This means that when the trader is not “doing his homework” he needs to be at the trade station following the equity which he is trading.

The last of the trading basics mentioned here the periodic review of trading results. This is not the least important of the basics; it is the most essential to long term success. No one is capable of setting up a trading strategy for all seasons. Markets change, rules change, currencies change, and trading software changes. A trade needs to review his results and then review his trading process. It is by doing so that the trader gets better at predicting stock price, learns how to spot a stock market correction, and learns to avoid overpriced stock. It is by following the basics that the trader comes to long term success.

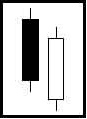

Let the market tell you what the market is doing! This is sage advice that comes from the Japanese Rice traders. Their centuries of falling candlestick signals developed a very simple trend analysis program. It provided the visual graphics of what investor sentiment was doing. This has a completely different investment philosophy than what has been created over the past 100 years of Wall Street analysis. The purpose of fundamental analysis is to reveal which stocks/sectors will have the greatest potential for the future. Investing in future price movements based upon fundamental research is a high risk/low probability investment program. Yet it seems to be the most accepted in this day and age. The Japanese Rice traders had a completely different perspective on how to make money from the markets. Let the market tell you what the market is doing! Then invest in those entities that are confirming what the market is conveying.

The Dow chart reveals a very slow steady uptrend for the month of December. The market indexes can provide a certain amount of statistical direction based upon the first few trading days of a new year. The Dow had been up over 125 points during the day. This was the first time the Dow has moved in a range more than 100 points in the last four weeks of trading. This low volatility phenomenon last occurred in 1996. A strong bullish characteristics of todays trading indicated the Bulls still in control. The magnitude of todays trading reveals what the thought process was for many money managers as they were assessing whether 2011 was going to be a strong or weak year.

A strong bullish move in the overbought conditions usually indicate exuberance coming into the trend. However, closer analysis to today’s trading revealed many stocks moving in the same range as they have been for the past four weeks, there just was more stocks moving positive. This would indicate a continuation of the buying. The exuberance was not showing up. This would indicate more upside trading on the short term. The strength of the market revealed in the first week of a new year is usually a prelude to the strength of the market over the year. This is one of the rules of thumb. Do rules of some always work? Not necessarily, but the anticipation of certain expect nations can be better verified by witnessing what the candlestick signals are doing during specific time frames.

The combination of these indicators are very important for portfolio management as well as option training. Just as the first week provides an indication of the potential strength of the market trends for the year, the strength of a candlestick signal will illustrate the strength of a price move. Obviously, the stronger the signal, the more compelling for establishing a position of a portfolio. The strength of a signal will also determine what type of option strategy should be applied to the trade.

Mini option training – Tuesday night January 4, 2011.

Tomorrow night will be a two-hour introduction to option training presented by the Candlestick Forum. This training is to introduce investors to the basics of options. Why they are used, how they are used most effectively, and how to apply the correct training strategy to the correct trend analysis. Most investors oversimplify the option training strategies. If a stock price is going higher, by the calls! That is where most investors lose their money. Learn how to correctly use calls and puts. Learn how to correctly use call strategies and put strategies. Time and magnitude are very important factors for trading options correctly. Join us to learn the basics of options and how they can be applied successfully using candlestick analysis.

Chat session tonight at 8 PM ET – the strong sectors for the beginning of 2011

Good Investing,

The Candlestick Forum Team

HOLIDAY SPECIALS FOR THE INVESTOR WHO HAS EVERYTHING

HOLIDAY GIFT PACKAGES – Free Shipping today!

Profitable Candlestick Trading

Candlestick Signal Flash Cards

Major Signals Mouse Pad

Special Gift Membership Subscriptions

Current Website Special

Fast Track On Trading – ON SALE!!!

Website special reflects current newsletter. If you are reading an archived newsletter you will be directed to Current Website Special