Traders will sell commodity futures when they believe that the price of the commodity will drop substantially between the time they sell the commodities contract and the contract settlement date. The trader will rarely hold contracts to settlement but will buy a commodity futures contract with the same settlement date in order to exit the commodities trading position. When the spot price is sufficiently below the contract price it is profitable to sell commodity futures and then buy at the lower price to profit from trading commodities. Traders will commonly use both fundamental and technical analysis tools in order accurately predict commodity price movements. Technical analysis tools such as Candlestick analysis have helped commodities traders for centuries in anticipating how a commodity will trade in coming hours, days, weeks, and months. Anyone beginning commodity futures trading will do well to take Commodity and Futures training in order to understand basic commodity trading and to profit by successfully trading commodity futures.

Although a trader will enter into a contract to sell commodity futures he or she will only rarely deliver on the contract. This is the business of producers and buyers of commodities and is called hedging. In this case a gold mining company may sell gold futures or an agricultural cooperative may sell corn futures. An oil company could, in fact, sell oil futures. In each case the seller will be in the business of the commodity in question and will, in fact, be able to produce the commodity for delivery. The company is hedging as a technique of controlling investment risk. This is a common practice and the backbone of the commodities markets. The large volume and liquidity caused by large buyers hedging risk provide the trader with an excellent opportunity to buy commodity futures or sell commodity futures for profit. The trader learns to predict market movement with the use of Candlestick pattern formations and similar technical analysis tools in order to decide whether it will be profitable to buy or to sell commodity futures.

Although a trader may sell commodity futures with settlement dates long in the future he or she need not wait for the settlement date to exit the contract. A commodity trader will watch the market for the commodity using market price tracking and prediction tools like Candlestick charting techniques. When a gap opens up between the contract price for the commodity future and the current commodity futures price the trader can exit his of her position for a profit and never worry about sleeping through the settlement date and having to deliver several hundred head of live cattle to a stockyard in Kansas City or Chicago! Like much of trading derivatives the trader enjoys a fair amount of leverage when he or she decides to sell commodity futures. With a relatively small investment compared to the actual price of the commodity, in contract volume, the trader can make a substantial profit as compared to his invested capital by careful and well practiced use of technical analysis using Candlestick basics.

Market Direction

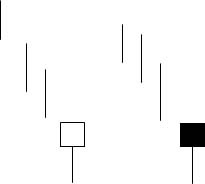

Why did candlestick investor’s buy aggressively on Wednesday while other investors invested timidly? The candlestick investor had a very high probability trade signal being confirmed. The Inverted Hammer signal is one of the 12 major signals. It does not occur as often as the other signals, however when it does occur, the results can be depended upon for its high percentage correct trade results. A candlestick Inverted Hammer signal, followed by a positive open the next day, will result in somewhere around a 95% probability the uptrend has started. With probabilities like this, the candlestick investor can invest aggressively upon seeing the confirmation. This is what we witnessed in the Dow on Wednesday. Tuesday formed an Inverted Hammer signal. Wednesday’s pre-market futures were opening positive. A number of individual stock charts were setting up for very bullish price move.

DOW

Being able to analyze the direction of the market creates a huge advantage for the magnitude and aggressiveness an investor can enter a trade. Knowing the probabilities of a successful uptrend on an Inverted Hammer confirmation, buying immediately into individual stock charts that were confirming price patterns becomes an easy process. Where is a good portion of profits usually generated? Just as the trend is turning. There is a rush for investors to get back into a price move once they see a reversal has occurred. Fortunately, the candlestick investor can take advantage of the reversal immediately where most investors will require additional confirmation.

Being prepared for a bullish move in the markets allows for aggressive buying into individual charts that are showing high probability/high profit trade situations. PWER was purchased on the open today when the markets were confirming continued positive moves after the Inverted Hammer confirmation. A positive move would have revealed a breakout of an obvious resistance level. Knowing the expectation of a breakout, this allows an investor to be participating in a price move that has big profit potential.

PWER

The investment psychology behind candlestick signals is very simple. This makes the logic very simple for applying positive trade situations. Unfortunately, most investors learn how to invest based upon the sage advice that comes from Wall Street. As has been experienced through many years, the accepted practices of the Wall Street culture provides mediocre returns at best. Candlestick analysis pinpoints the high profit, low risk trade situations. This technique of investing permits an investor to control their own profitability. The analysis of which signals and patterns can produce the biggest profits is not a difficult process to learn. The Candlestick Forum provides a two day training program that puts the logic that is built into candlestick signals into a very orderly learning process. This is not theoretical information. This is the nuts and bolts that has been utilized for centuries for very successful rice trading. You may not have any background in technical analysis. With candlestick signals, you do not need it.

The Candlestick Forum two day training program, scheduled for July 10 and 11 has been postponed until July 24 and 25th. If you have been attending the Thursday night and Monday night training sessions, you should have noticed the methodical, common sense applications used for analyzing trades. Candlestick analysis, unlike fundamental analysis, reveals what prices are doing, not what prices might do in the future. If you are serious about improving your trading and investing techniques, please take the time to attend a two-day training session. You will be amazed how much more clearly you understand the concept of candlestick analysis when it is presented in an orderly manner. Click here for more details.

Chat session tonight 8 PM ET

Good Investing,

The Candlestick Forum Team

Training Webinars

Candlestick Technical Analysis Webinar

Website special reflects current newsletter. If you are reading an archived newsletter you will be directed to Current Website Special.