Stock market tips are usually the demise of most investors. The dream of most investors is to find the stock market tips that are going to make them wealthy. Unfortunately, that does not happen. Depending upon stock market tips will lead most investors into a demoralizing method of investing. Consider the factors that surround stock market tips. The information is usually relatively old by the time it reaches the ordinary investor. If the stock market tips are coming from an acclaimed guru of a stock market, it has probably been well positioned into accounts before the general public is made aware of the recommendation.

What you do when executing stock market tips? That should be the first question. Most stock market tips emphasize getting into the position as quickly as possible. Whatever great things are going to happen in the stock price are going to happen soon. Stock market tips are not representative of an intelligent investment strategy. Investing involves implementing a program where an investor can continue to improve return results. Candlestick signals provide the format for establishing consistent investment returns.

The major problem that comes from putting funds into everybody’s stock market tips is very simple to understand. If that particular investment situation does not perform as expected, the investor is right back where they started. They do not have a viable investment strategy. Candlestick signals, on the other hand, are based upon high probability situations. Establishing a position based upon one of the major candlestick signals allows an investor to evaluate when to get into a position and when to get out of a position.

The signals are the result of many centuries of observations. If the statistical results of the major candlestick signals were not proven, we would not be looking at them today. The psychology built into a major signal is simple common sense investment philosophy. As demonstrated in the piercing signal, the Japanese Rice traders have a high expectation of what the result should be. Having this knowledge makes investment programs very easy to implement.

Description

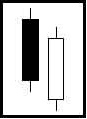

The Piercing Pattern is composed of a two-candle formation in a down-trending market. The first candle is black, a continuation of the existing trend. The second candle is formed by opening below the low of the previous day. It closes more than midway up the black candle, near or at the high for the day.

Criteria

- The body of the first candle is black; the body of the second candle is white.

- The downtrend has been evident for a good period. A long black candle occurs at the end of the trend.

- The second day opens lower than the trading of the prior day.

- The white candle closes more than halfway up the black candle.

Signal Enhancements

- The longer the black candle and the white candle, the more forceful the reversal.

- The greater the gap down from the previous days close, the more pronounced the reversal.

- The higher the white candle closes into the black candle, the stronger the reversal.

- Large volume during these two trading days is a significant confirmation.

Pattern Psychology

After a strong downtrend has been in effect, the atmosphere is bearish. Fear becomes more predominant. The prices gap down. The bears may even push the prices down further. However, before the end of the day, the bulls step in and dramatically turn prices around. They finish near the high of the day. The move has almost negated the price decline of the previous day. This now has the bears concerned. More buying the next day will confirm the move.

Being able to utilize information that has been used successfully in the past is a much more viable investment strategy than taking shots in the dark. Keep in mind, when you are given privileged information about stock market tips, where you are in the food chain. Are you one of those privileged few that gets top-notch pertinent information on a timely manner, or you one of the masses that feed into a frenzy and allow the smart money to make the profits?

Training Tutorial

Remarkable results have been observed with this signal. This 35 minute video provides a clear understanding of what this signal indicates and how to trade it for profit.

Candlestick Forum Flash Cards These unique Flash Cards will allow you to be “trading like the Pro’s” in no time.

Speak Your Mind