Commodity trading charts are very easy to read using candlestick signals. Commodity trading charts are very important for investors using higher leveraged commodity trades. Candlestick signals clearly illustrate where reversals occur in price trends. They work more effectively on commodity trading charts than they do on stock trading charts. Commodity trading charts usually reveal a long and sustained trend. Commodities trade differently than stocks. They have less outside influences to affect the price trend. Candlestick signals reveal when these trend changes are occurring.

Commodity prices do not have numerous factors that will change a price trend. Most of the time, commodity prices move basically on supply and demand issues. That is the true nature of free markets at work. Candlestick signals pinpoint when a change of a major trend is going to occur. Investor sentiment is the true gauge for identifying when supply and demand is changing course. The Japanese Rice traders made fortunes trading the most basic of commodities, Rice. The information that is conveyed by the individual candlestick signals produces recognized formations. These formations/signals have not only been identified by Japanese Rice traders, they were able to evaluate what the investor sentiment was doing at these reversals. This information is very valuable when analyzing commodity trading charts. The same information is easily applied to any trading entity. Investor decisions remain constant throughout the centuries. Fear and greed become a vital part of the movement of prices.

Commodity traders gain a huge advantage when able to recognize reversal signals. The most proven and tested reversal signals are candlestick signals. They have been utilized successfully for centuries. Having a visual pattern that demonstrates the change of investor sentiment is a valuable cool. An investor that can recognize the reversal signals to have worked effectively for centuries improves their probabilities of being in the right trade at the right time. Each of the signals has advantageous elements. Whether a major signal or a secondary signal, applying candlestick analysis to commodity trading charts will dramatically improve an investor’s profits. Learn how to interpret these simple reversal signals, and the probabilities become greatly enhanced in the investor’s favor.

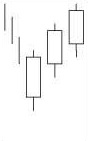

This Secondary Signal, The Three White Soldiers, is one of many strong reversal patterns.

Three White Soldiers

Description

The Three White Soldiers (also known as The Advancing Three White Soldiers) is a healthy market reversal pattern. It consists of three white candles, the second and third candles opening lower than the previous close but closing at a new high.

Criteria

- Each consecutive long candle closes with a higher open.

- The second and third candlesticks open in the previous day’s body.

- Each day should close very near its high for the day

- The opens should be within the top half of the previous day’s body.

Pattern Psychology

After a downtrend or a flat period, the presence of this formation suggests a healthy rally will occur. The strength of this formation consists of the fact that each day, the lower open suggests that sellers are present. By the end of each day, the buying has overcome the early sellers. This represents that a healthy continued rally has selling occurring as it is happening. As in any rally, too much buying with little selling can be dangerous. This Bullish reversal pattern needs no confirmation.

Candlestick Forum Flash Cards These unique Flash Cards will allow you to be “trading like the Pro’s” in no time.

Speak Your Mind