The basic characteristics of Candlestick signals can produce extremely strong profits. The signals become an integral part of analyzing that a high profit pattern may be forming. The first indication of the development of a high profit pattern can be identified when Candlestick signals appear.

Stock market graphs have become dramatically more sophisticated in the past 10 years. Computer software services provide excellent stock market graph capabilities. Candlestick signals allow investors to clearly evaluate price movements using online stock market graphs.

The major benefit today’s investors have is the ability to do multiple technical analysis research processes instantly. Most online stock market graphs can be customized to the investors specifications. Having stock market graphs clearly illustrating Candlestick signals makes finding high profit patterns very easy to find.

Candlestick signals make analyzing reoccurring patterns much easier to evaluate on stock market graphs. An investor will be able to identify reoccurring human reactions much faster when knowing the implications of the signals. The benefit of being able to identify Candlestick signals is that it alerts an investor that high profit patterns are developing. Candlestick signals can provide immediate proper analysis of many patterns. Being able to identify a high profit pattern developing, and visualizing the confirmation with the signals, allows an investor to exploit profits at the most opportune times. One of the most profitable signals is the Scoop pattern.

The Scoop pattern works very effectively. It can be visually recognized easily. The Candlestick signals allow an investor to exploit it properly. The explanation of how and why it works is subjective.

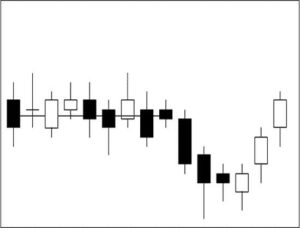

The pattern is formed after a lengthy period of flat trading. The flat trading is usually composed of small, indecisive trading days. After a recognized flat trading time frame, the price starts to back down. The flat trading period is considered the “handle” to the scoop.

The term “recognized” is visually determining a flat trading area. The flat trading will usually sustain for a longer length of time than what is usually seen in the price movement of that trading entity. It becomes obviously lengthy to the point where it becomes boring.

It may be the boredom that finally makes the price head down. Investors get tired of waiting for it to do something. However, after a few days the small “buy” signals start showing up. The price starts moving back up toward the flat area, creating the scoop.

An inordinate percentage of the time, when the price comes back up to the flat trading area, the trend continues in a strong upward direction. This may be the result of everybody that was bored with the trading seeing that it is finally moving and start adding to their positions again.

Scoop Pattern

The visual recognition of the handle, being followed by the pullback, should be the “alert”. Seeing new buying, after a few days of a pullback, is a set up for a low risk trade. Buying near the bottom of the scoop allows the stop loss area to be at the low of the scoop. The first test should be the flat trading area. A breakout through that area indicates that a good trend is in the making.

The Affiliated Computer Services chart reveals a flat trading period followed by the price breaking down. After just a few days of a pullback, bullish Candlestick signals started to appear. Being able to visualize the handle, followed by a pullback, then witnessing Candlestick “buy” signals, should alert the Candlestick investor to the potential of a Scoop pattern forming.

Affiliated Computer Services

Having the ability to recognize when a potentially high profit pattern is forming will dramatically increase profit potential. The use of simple visual chart analysis can be fine-tuned when recognizing when a trend is about to reverse. That knowledge allows an investor to take advantage of Scoop pattern profits at their optimal buying points.

Speak Your Mind