The summer of 2005 was a very profitable one. The ideas that were discussed in the Candlestick Forum’s online stock trading forum resulted in some big profits. The online stock trading forum has multiple benefits. First, it exposes investors to stock trading ideas that they may not have found themselves. Additionally, an online stock trading forum oriented toward a trading methodology, such as Candlestick signals, allows investors to get better insights on how that trading methodology operates.

Unlike last summer, the stock market was much more active this summer. This made the activity on an online stock trading forum much more relevant. The nature of the market this summer allowed investors to participate in some very profitable moves. “Let the markets tell you what the markets are going to do.” This is the primary function of Candlestick signals. The Japanese rice traders use the signals to analyze the direction of trends.

Candlestick formations allow a Candlestick investor to much more accurately evaluate the investor sentiment of a trend. As you may have noticed, the advice from the Candlestick Forum had been that although the overall trend in the beginning of the summer was not strongly bullish, it would be a slow uptrend. The call for late June was to take profits and go short. The call for early July was to go long. The call from late July to the end of August was that although a downtrend was going to be slow, there were too many stocks/sectors that were still acting strong. How did the Candlestick analysis project the trend so accurately? That will be a topic for discussion in an upcoming chat session.

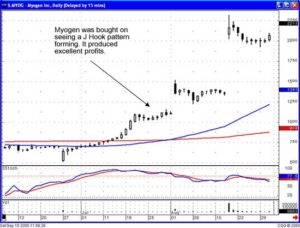

The ability to analyze the directions on the market with relative accuracy allows the Candlestick investor to exploit the big profit potentials. Although most of the summer trading activity seemed relatively boring, the Candlestick signals were exemplary in one vital facet. They pinpointed the stocks that had the probability of profitable moves.

Although the markets have been relatively lethargic over the summer, the Candlestick signals identified some high profit potential trades. Not only will Candlestick signals identify profitable trades, the correct formations set-ups identify high-profit trades. Does this mean that every established position results in good profits? Definitely not! But it did create a trading program where many trades were slightly positive, flat, or slightly negative, maintaining the equity of the account. However, the inherent attributes of the Candlestick signals put us in positions that did result in a high profit situation. These results were nothing more than placing funds in what potentially was a high profit possibility. Being able to participate in an occasional high profit trade, especially in a flat trading market, helps increase the total monthly returns.

These are just a few examples of some of the big trade results from the Candlestick Forum picks during the summer. They are not being presented for any bragging purposes. The point that is trying to be demonstrated is that even when the markets were not all that wildly exciting, the Candlestick signals pinpointed some high profit trade potentials.

With the markets being in a slow steady downtrend, not all recommendations performed properly. However, just as the Candlestick signals illustrate when it is time to buy, they also illustrate when a trade is not working. That provides an excellent stop-loss management process. The vast majority of losing trades have minimal losses. If the signals do not confirm, they are closed out immediately. Those losses were well offset with numerous positions that worked moderately well, being up 3%, 5%, and 7%. The combination of the majority of positions produce a respectable positive return each month. What greatly enhances the returns is being able to participate in an occasional big profit position.

Bottom line, the point of this illustration is to educate investors of the fact that Candlestick signals will have an investor in large profit trades in an inordinate percentage of the time. “Let the markets tell you what the markets are going to do.” This summer the markets showed us that the majority of stocks would be trading relatively flat but that there would be pockets of stocks moving. The Candlestick signals easily identified those pockets.

Speak Your Mind