Description

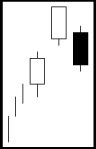

The Upside Gap Three Method is a simplistic pattern, similar to the Upside Tasuki Gap, occurring in a strong trending market. In an uptrend, a gap occurs between two white candles. The final day opens within the top white body and closes in the lower white body, filling the gap between them.

Upside Gap Three Method

Criteria

- In an uptrend, two white candles form, having the second one gapping above the first.

- The third day opens lower, int he body of the top white candle and closes int he body of the first white candle.

Pattern Psychology

A market has been moving in a direction,t hen a gap appears between two white candles. Gaps have significance in that they eventually have to be filled. The fact that it becomes filled immediately leads investors to think that the pullback is just a profit taking pullback. The trend should resume immediately after the gap filling is satisfied.

Speak Your Mind