Learn CANDLESTICK TRADING with Stephen Bigalow via online webinar training sessions the perfect technical analysis tool for swing trading.

Swing Trading, a relatively popular trading technique. The advent of computers over the past seven to ten years has opened the opportunity for investors to trade stocks and other investments from their home or office. The vast improvement in charting services on the Internet now provides a method for individuals to take advantage of the quick fluctuations in stock prices. Swing trading provides investors a huge opportunity to make profits. As the market sentiments evolve, long term investing becomes less of a dominant form of investing. Swing trading has many advantages over long term investing, especially when implementing with a timing technique such as candlestick trading. Swing Traders will typically hold a particular stock for anywhere from a few days to a few weeks but trade on the basis of the stock’s intra-week or intra-month price changes.

Candlestick analysis has “common sense” built into its signals. Understanding the investor sentiment prepares the candlestick investor to maximize profits in short term swing trading. To get into a trade at the optimal point, anticipating when a trend is about to reverse, is crucial. Understanding how the common investor thinks and reacts permits fast profits to be made by swing trading.

When most trends reverse, they do so with vigor. The initial day or two of a trend reversal can produce magnificent profits. Swing trading is centered upon taking advantage of that initial move. If the trader has the tools to find and exploit these moves, swing trading becomes a profitable and comfortable form of extracting profits from the market. Our contention is that the candlestick signals ARE the tools needed.

Swing trading requires the alignment and concentration of events to maximize profits. Long-term investing does not require the stringent perusal of profit parameters. How often have you heard somebody rationalize about a setback in their position, “Oh well, I’m in it for the long term.” This statement is often uttered instead of taking a progressive stance towards one’s investment goals.

Swing trading represents the exact opposite. An investor trying to maximize profits from a two to ten day holding period has to have analyzed all elements. When swing trading, the establishment of a trade has to be exacting in its purpose, making a profit NOW in that trade.

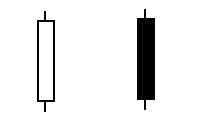

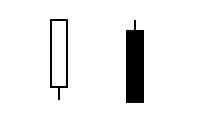

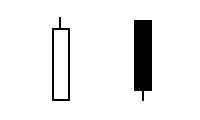

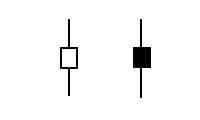

The innate characteristics built into candlestick signals produce the parameters that make swing trading successful. The recognition of pattern reversal in a trend can be visually depicted in the signals. For the aggressive swing trader, knowing how the signals are formed can produce trades that pinpoint the exact point in which to enter a trade. Additionally, the same indications that get the candlestick swing trader into a trade will alert the trader when it is time to get out.

As seen in the following chart, notice the Doji signals at each turn. Knowing what to do after each signal creates the format for profitable swing trading. Knowing the simple rules about what to do once observing a Doji has the candlestick swing trader in and out of trades at the optimal points.

Swing Trading, Doji

Learning the methods to evaluate the signals makes swing trading an easy program to extract profits out of the market consistently. Candlestick signals provide two valuable facets. First, the signal searches locate the high potential profitable swing trades. The searches can be constructed to find the signals that occur at the best positions during a trend movement. Finding a candlestick buy signal when stochastics are oversold or searching for a gap up after a Doji are a couple of examples on how to fully utilize the search capabilities. The second facet is the pinpointing when to get into and out of a trade as explained earlier.

Swing trading concentrates on the alignment of parameters to maximize profits. The candlestick signals add the dimension of allowing successful trades to run, as well as showing when a trade has fizzled. The Candlestick Trading Forum specializes in identifying trades suitable for the swing trading investment community. Please review the services provided on the website. Swing trading lies at the core of Mr. Bigalow’s assertion that the candlestick signals can be traded to produce 10% per month return from the stock market. Join the community of traders that search, research and make available swing trading ideas on our Forum and Stock Chat Room.