If you only knew what the market was going to do before it did it, you would be rich by now. If a thought like that has run through your mind before, you are going to love this topic. It may seem like successful traders have the ability to see movement in the market before it happens. While there are no known psychic stock investors, it is possible to develop the ability to determine movements in the market before they occur and you won’t even have to use a crystal ball or bend spoons with your mind! All you need is to do your technical analysis and use the best market analysis system available.

What Is a Market Analysis System?

This sounds so good that if you don’t know, you are probably wondering what a market analysis system is. This is a method for tracking the market and looking for stock market trends, either of the entire market or of a particular stock. A market analysis system can be something simple like a bar chart or something more sophisticated like the Japanese Candlesticks. Both are market analysis systems but there are substantial differences between them and that difference can help you know what is happening in the stock market.

Bar Charts and Japanese Candlesticks

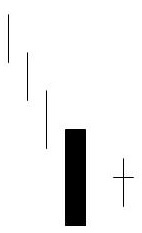

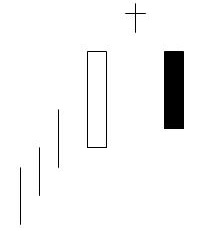

Bar charts, like Japanese Candlesticks charts, are a type of market analysis system. Bar charts consist of a series of ranges, the open and close for the market or a particular stock each day. By studying this data, an investor can try to determine a day’s event and when he or she analyzes the data for a week or month and tries to find trends. The problem with bar charts as a market analysis system is that there just isn’t much data provided and there is no underlying stock technical analysis provided. For example, if a stock closed yesterday at $5, opened today at $5, rose to $20 at mid-day, then fell to $6 at close, only the range between $5 and $6 would be reflected in your bar chart.

With candlestick analysis, the level of data provided is much higher. You still have open and close prices but you also have things like daily high, daily low and comparisons to previous close. If you use the example we mentioned for bar charts, you would have a body that reflected the difference between $5 and $6, a vertical line that extended up to $20 and the body color would represent the relationship of the opening price to the previous close. It is easy to see that this market analysis system provides much more stock market information than a simple bar chart.

Candlestick charts are the oldest type of price predicting charts, dating back to the 1700’s when they were used for predicting rice prices. In fact, during this era in Japan, Munehisa Homma became a legendary rice trader and gained a huge fortune using candlestick analysis. He is said to have executed over 100 consecutive winning trades! Candlestick charting still has a strong reputation as a market analysis system today. It is said to enable the investor to spot market trends three days before they occur.

Conclusion

A market analysis system is an important part of your stock trading plan. With a system like Japanese Candlesticks an investor has access to more data and the analysis abilities only Candlesticks provides. The strength of this system gives the investor the ability to see the market move without having to buy a crystal ball!