Just like the Major Candlestick Images and Explanations page, this page provides all the information you need to learn the Candlestick Secondary Signals.

The Secondary Signals are titled as such because they do not appear as frequently as The Major Signals. That does not negate the effectiveness or their importance for identifying reversals. Being aware of the implications of these Secondary Signals in Candlestick Charts provides additional opportunities during the course of investment decisions.

Tri Star Pattern

Recognition: The Tri Star pattern is comprised of a three-day pattern, all doji days.

Pattern Psychology: Doji reveals indecision in the bull’s and the bear’s camp. Any investor that had any conviction is now reversing their position.

Related Articles: Trading the Tri-Star Pattern

Training Tutorial: Candlestick Forum Flash Cards

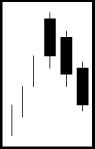

THREE BLACK CROWS

Recognition: Three long black candles occur, after a strong uptrend, all of close to equal length.

Pattern Psychology: The uptrend has now reached levels where the sellers have started to step in. This persistent pressure by the Bears provides the potential for a strong downtrend.

Related Articles: Trading Three Black Crows Pattern

Training Tutorial: Candlestick Forum Flash Cards

THREE IDENTICAL CROWS

Recognition: The Three Identical Crows have the same criteria as the Three Black Crows. The difference is that the opens are at the previous day’s close.

Pattern Psychology: After an uptrend a long black candle forms. However, the selling is more severe and there do not appear to be any buyers at the next day’s open. This indicates a much greater motivation to get out of the position.

Related Articles: Trading the Three Identical Crows Pattern

Training Tutorial: Candlestick Forum Flash Cards

TWO CROWS

Recognition: It is a top reversal pattern only after an obvious uptrend.

Pattern Psychology: After a strong uptrend has been in effect, the price gaps open but cannot hold its gains. The further the third day closes into the last white Bullish candle, the more bearish it is.

Related Articles: Trading the Two Crows Pattern

Training Tutorial: Candlestick Forum Flash Cards

UPSIDE GAP TWO CROWS

Recognition: Three-Day reversal pattern with a Gap Up in the Uptrend

Pattern Psychology: After a strong uptrend, there is last gasp buying at the top causing a gap in price.

Related Articles: Trading the Upside Gap Two Crows Pattern

Training Tutorial: Candlestick Forum Flash Cards

UNIQUE THREE RIVER BOTTOM

Recognition: Three-Day reversal pattern at the end of a strong downtrend.

Pattern Psychology: After a strong downtrend the Bears would appear to be in control, but this rare pattern provides an early indication of a successful reversal ahead.

Related Articles: Trading the Unique Three River Bottom Pattern

Training Tutorial: Candlestick Forum Flash Cards

THREE WHITE SOLDIERS

Recognition: Three-Day reversal pattern is easily identified by three large Bullish candlestick signals, an obvious pattern of buying.

Pattern Psychology: A strong downtrend or flat trading period with buyers overcoming the early sellers.

Related Articles: Trading the Three White Soldiers

Training Tutorial: Candlestick Forum Flash Cards

THREE INSIDE UP & THREE INSIDE DOWN

Recognition: Three-Day reversal pattern alerted by the appearance of a Harami signal.

Pattern Psychology: The Harami is the first indication that the trend has stopped.

Related Articles: Trading the Three Inside Up or Down Reversal Pattern

Training Tutorial: Candlestick Forum Flash Cards

MEETING LINES

Recognition: Meeting lines are formed when opposite colored bodies have the same closing price.

Pattern Psychology: After a strong trend, there is a continued gap in the direction of the trend. (see detailed description in Trading the Meeting Lines)

Related Articles: Trading the Meeting Lines

Training Tutorial: Candlestick Forum Flash Cards

BELT HOLD

Recognition: Strong trend in price, followed by a gap in the same direction as the trend.

Pattern Psychology: After a strong trend, there is a gap in the same direction but the opening price does not hold causing investors to begin covering their positions.

Related Articles: Trading the Belt Hold Pattern

Training Tutorial: Candlestick Forum Flash Cards

THE BREAKAWAY

Recognition: A gap down found during a declining trend

Pattern Psychology: If the gap does not fill the Bears have maintained control.

Related Articles: Trading the Breakaway Pattern

Training Tutorial: Candlestick Forum Flash Cards

THREE STARS IN THE SOUTH

Recognition: Obvious down-trend in stock price.

Pattern Psychology: The shadows, or tails, indicate that some buying has presented itself.

Related Articles: Trading Three Stars in the South, Three Stars in The South.

Training Tutorial: Candlestick Forum Flash Cards

ADVANCE BLOCK

Recognition: In an uptrend, or a bounce up during a long downtrend, the candle bodies becoming increasingly smaller.

Pattern Psychology: Reveals a slowing of the buying.

Related Articles: Trading the Advance Block Pattern , Advance Block Pattern

Training Tutorial: Candlestick Forum Flash Cards

DELIBERATION

Recognition: Uptrend in stock with candle sizes diminishing.

Pattern Psychology: A slow down in represents buyer weakness

Related Articles: Trading the Deliberation Pattern

Training Tutorial: Candlestick Forum Flash Cards

CONCEALING BABY SWALLOW

Recognition: The pattern is in a downtrend, two large black candles continue the downtrend and is followed the third day with a gap down reverse hammer formation.

Pattern Psychology: While the trading ended at the low, the magnitude of the downtrend is greatly diminished.

Related Articles: Trading the Concealing Baby Swallow , Concealing Baby Swallow

Training Tutorial: Candlestick Forum Flash Cards

Recognition: This pattern looks similar to an ‘ice cream sandwich’., with one white candle sandwiched in between two dark candles.

Pattern Psychology: The Bears are forced to cover short positions upon seeing new buying strength coming into the market.

Related Articles: Trading The Stick Sandwich

Training Tutorial: Candlestick Forum Flash Cards

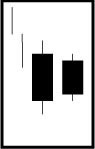

Recognition: Similar to the Harami except for the color of the second day’s body.

Pattern Psychology: The appearance of support in a strong down trend gets enough attention from the Bears that they begin covering their short positions.

Related Articles: Trading the Homing Pigeon

Training Tutorial: Candlestick Forum Flash Cards

Recognition: A strong downtrend is in effect with the reversal apparent with a gap up on the fourth day.

Pattern Psychology: The gap up causes the Bears to start scrambling to cover their positions before the Bulls take over.

Related Articles: Trading the Ladder Bottom

Training Tutorial: Candlestick Forum Flash Cards

Recognition: A downtrend is in place when two trading days close on their lows, at the same level.

Pattern Psychology: The Bears get uneasy upon seeing their presence is no longer moving the price down.

Related Articles: Trading the Matching Low

Training Tutorial: Candlestick Forum Flash Cards

This is the last pattern in our series for Candlestick Secondary Signals. You are now ready to move on to Candlestick Continuation Patterns.

Speak Your Mind