The Doji is one of the most revealing signals in Candlestick trading. It clearly indicates that the bulls and the bears are at an equilibrium, a state of indecision. The Doji, appearing at the end of an extended trend, has significant implications. The trend may be ending. Just this fact alone creates a multitude of investment programs that produce inordinate profits. What is the best method for making big trading profits? Knowing the direction of a trading entity and the strength of that move, Candlestick analysis perfects the trading strategy. Candlestick formations reveal high probability profitable reversals. Hundreds of years of investing refinement have proven that point.

Candlestick analysis incorporates approximately 50 to 60 Candlestick signals. However, twelve of the signals, considered the major signals, will produce the vast majority of the trend reversals. Recognizing and understanding the psychology that formed these major signals will provide completely new insights for investors in understanding optimal times to buy and sell. Japanese rice traders realized that prices do not move based on fundamentals, they move based on the investor perception of those fundamentals. The Doji signal is one of the most predominant reversal indicators. It is very effective in all-time frames, whether using a one-minute, five-minute, or fifteen-minute chart for day trading or daily, weekly, and monthly charts for the swing trader and long-term investor.

The Japanese say that whenever a Doji appears, always take notice. A well-founded rule of Candlestick followers is that when a Doji appears at the top of a trend, in an overbought area, sell immediately. Conversely, a Doji seen at the bottom of an extended downtrend requires buying signals the next day to confirm the reversal. Otherwise, the weight of the market could take the trend lower.

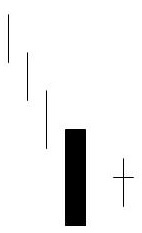

The Doji signal is composed of one candle. It is formed when they open and the close occur at the same level or very close to the same level in a specific time frame. In Candlestick charting, this essentially creates a “cross” formation. As the following illustration demonstrates, the horizontal line represents the open and close occurring at the same level. The vertical line represents the total trading range during that time.

Doji Star

![]()

Upon seeing a Doji in an overbought or oversold condition, an extremely high probability reversal situation becomes evident. Overbought or oversold conditions can be defined using other indicators such as stochastics, When a Doji appears, it is demonstrating that there is indecision now occurring at an extreme portion of a trend. This indecision can be portrayed in a few variations of the Doji.

The Long-legged Doji is composed of long upper and lower shadows. Throughout the time period, the price moved up and down dramatically before it closed at or very near the opening price. This reflects the great indecision that exists between the bulls and the bears.

Long-legged Doji

![]()

The Gravestone Doji is formed when the open and the close occur at the low end of the trading range. The price opens at the low of the day and rallies from there, but by the close the price is beaten back down to the opening price. The Japanese analogy is that it represents those who have died in battle. The victories of the day are all lost by the end of the day. A Gravestone Doji, at the top of the trend, is a specific version of the Shooting Star. At the bottom, it is a variation of the Inverted Hammer.v

Gravestone Doji

The Dragonfly Doji occurs when trading opens, trades lower, then closes at the open price which is the high of the day. At the top of the market, it becomes a variation of the Hanging Man. At the bottom of a trend, it becomes a specific Hammer. An extensively long shadow on a Dragonfly Doji at the bottom of a trend is very bullish.

Dragonfly Doji

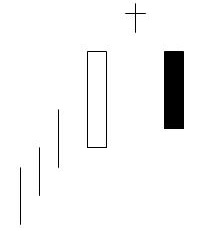

Doji that occur in multi-signal patterns make those signals more convincing reversal signals.

Harami Doji Evening Star – Abandoned Baby

Having the knowledge of what a Doji represents, indecision, allows the Candlestick analyst to take advantage of reversal moves at the most opportune levels. Regardless of whether you are trading long-term holds for day trading from the one-minute, five-minute, and fifteen-minute charts, the Doji illustrates indecision in any time frame.

A prime example can be seen in the Taser chart from this past year. The Candlestick signals become an important tool to cut through all the investment rhetoric. As was demonstrated during Tasers price run from approximately a $5 range up to the $65 range in a matter of months, the news station commentary started exuding accolades on the company’s products. As the price skyrocketed, it became clear that the price had gotten well ahead of the fundamentals. But where did you take profits? Where did you start shorting a stock? That answer became obvious once we saw all of the huge Doji at the top.

This graphic illustration of indecision provided a format for taking profits or even, more aggressively, being prepared to short the stock on the next days lower open. The Doji becomes the illustration of indecision at these prices. This is not rocket science. It is based on the the observations of successful Candlestick trading over the past four centuries.