Stock market trading tools should have one primary function. Stock market trading tools should be easy to analyze, evaluate, and improve. Many stock market trading tools have come and gone. Some work for specific conditions of the markets, others work for only stock market trading. Candlestick signals have been around for centuries. The benefit of these trading tools is numerous. They can be used for any trading entity that involves investor sentiment. This includes stocks, commodities, futures, Forex, bonds or tulip bulbs.

The major advantage of candlestick patterns as a trading tool is that they have been proven to work effectively for centuries. The information incorporated into the signals can be readily applied to enhance emerging trading tools. Extracting profits from a stock market consistently becomes much easier when applying candlestick signals with common trading patterns. Investor psychology moves prices in waves. This has been occurring ever since the beginning of mankind. Applying candlestick signals to reoccurring trading patterns become a very high probability trading platform.

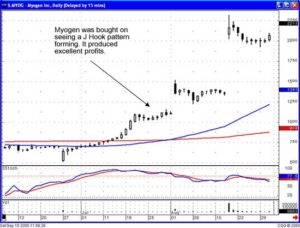

As illustrated and Steve Bigalow’s new book, “High Profit Candlestick Patterns” a Jay-hook pattern produces extremely good profits. It is an easy pattern to recognize and using the candlestick signals as trading tools, the investor can identify many potential patterns in their early stages of development. This allows the investor to maximize profit potential while at the same time reducing losses with simple stop loss procedures.

J-Hook Pattern

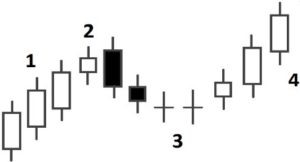

A Jay-hook pattern is a variation of a wave 1 — 2 — 3 pattern. It becomes an easy pattern to identify with the use of candlestick signals. The problem most investors have is understanding when to sell after a price has made a strong move. The Jay-hook pattern demonstrates some easily identifiable attributes. First, it starts with a strong uptrend, a trend that usually produces “stronger than normal” returns in a very short period of time. This strong up-move is significant enough to create the normal wave pattern. A reversal caused by profit taking, followed by a declining the trajectory of the pullback, then the continuation of the uptrend. The Jay-hook pattern is the description of the pullback that starts to round out at a bottom and starts moving back up, thus forming a ‘hook.’

This pattern provides the candlestick investor with some very simple profitable applications. The first uptrend will usually show clear candlestick ?sell? signals when it comes to an end. The top may be formed with the stochastics in the overbought area or very close to the overbought area. Because all the strong initial uptrend, the first evidence of ?sell? signals should be acknowledged. Even if it is suspected that the uptrend could be forming a Jay-hook pattern, why a risk remaining in the trade? When a sell signals become evident, take profits.

What criteria makes a candlestick investor suspect a Jay-hook pattern to form? The analysis of the market trends in general should provide that information. For example, if a stock price has had a strong run up while the market indexes have had a steady uptrend, and the market indexes do not appear to be ready for a significant pullback, then a strong stock move could warrant some profit taking before the next move up. The benefit of being able to identify candlestick signals is being prepared for the witnessing of some candlestick ?buy? signals after a few days of pullback. These signals would also alter the trajectory of the stochastics that will be pulling back.

Opportunity is missed by most because it is dressed in overalls and looks like work. ? Thomas Alva Edison

Witnessing Doji’s, Hammers, Inverted Hammers or Bullish Haramis, after a few days a pullback becomes an alert that the selling is starting to wane. If the stochastics are flattening out during that same time frame, then a set-up for a Jay-hook pattern is taking place. Taking profits when the first sell signals occurred in the initial uptrend eliminates the downside risk. Those candlestick ?sell? signals indicate that it is time to get out of the trade. Even though the strength of the initial move would warrant suspecting a Jay-hook pattern to form, there is no guarantee that the pullback couldn’t retrace 20%, 40%, 60% or even greater of the initial up-move.

This creates a trading strategy that allows for an investor to utilize the common sense built into the candlestick signals. When it is time to get out, get out! If after four days, small candlestick buy signals start forming, there is nothing wrong with buying back into the position. The second entry of this trade now has some targets that can be clearly defined. The first target should be the test of the recent high. Although this may not be a huge percentage return moving to that level, at least the probabilities indicate that it should be profitable.

The benefit of candlestick signals once again can be applied if and when that recent high is tested. Witnessing another sell signal, as the price approaches the recent high trading level, would be a clear indication that the recent high was going to act as resistance. This would induce taking quick profits and getting back out of the trade. On the other hand, if strong signals are seen as the recent high is breached, that would be a clear indication the high was not going to act as a resistance level. A new leg of the trend may be in progress.