There are technical analysis basics that can greatly enhance the production of extraordinary profits in the markets. Candlestick signals amplify the ability to identify high profit chart patterns. The visual aspects of Candlestick signals make evaluating high profit trades very easy.

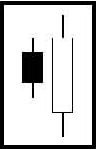

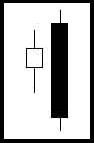

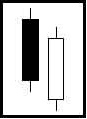

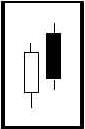

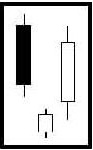

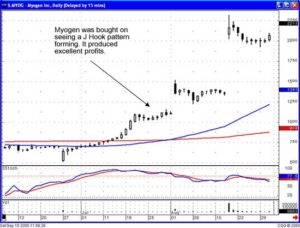

One of the technical analysis basics is identifying a Candlestick bullish signal followed by a gap-up. A gap, witnessed after a Candlestick “buy” signal, also has powerful implications. Knowing that a gap represents enthusiasm for getting into or out of a stock position creates the forewarning that a strong profit potential situation is about to occur or has occurred. Where is the best place to see rampant enthusiasm? At the point you are buying, near the bottom. Obviously, seeing a potential Candlestick “buy” signal, at the bottom of an extended downtrend is a great place to buy. In keeping with the concepts taught in Candlestick analysis, we want to be buying stocks that are already oversold, to reduce the downside risk. What is even better to see is the evidence that buyers are very eager to get into the stock.

Reiterating the technical analysis basics of finding the perfect trades, as found in the book “Profitable Candlestick Trading”, having all the stars in alignment makes for better probabilities of producing a profit. The best scenario for a high profit trade is a Candlestick “buy” signal, in an oversold condition, confirmed with a gap-up the following day.

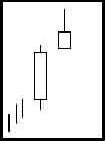

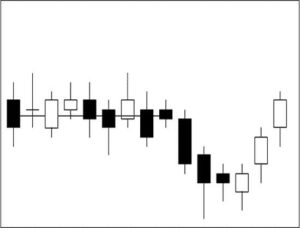

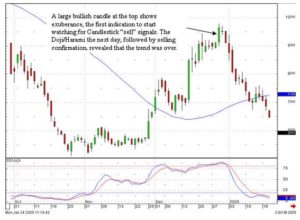

As illustrated in the Bombay Company Inc., the uptrend was obviously instigated after a gap-up and large bullish candle following a Doji. The fact that prices gapped up was immediate demonstration that buyers wanted to get into this stock with great fervor.

Unofficially, statistics illustrate an 80% or better probability that a trade will be successful when stochastics are oversold, a Candlestick “buy” signals appears, and prices gap up. (The Candlestick Forum will offer our years of statistical figures as “unofficial.” Even though over fifteen years of observations and studies have been involved, no formal data gathering programs have been fully utilized. However, the Candlestick Forum is currently involved with two university studies to quantify signal results. This is an extensive program endeavor. Results of these studies will be released to Candlestick Forum subscribers upon completion.)

Having this technical analysis basic statistic as part of an investor’s arsenal of knowledge creates opportunities to extract large gains out of the markets. The risk factor remains extremely low when participating in these trade set-ups.

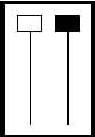

Many investors are afraid to buy after a gap-up. The rationale being that they don’t like paying up for a stock that may have already moved 3%, 8%, 10%, 20% already that day. Witnessing a Candlestick “buy” signal prior to the gap-up provides a basis for aggressively buying the stock. If it is a the bottom of a trend, that 3%, 8%, 10% or 20% initial move may just be the beginning of a 50% move or a major trend that can last for months.

Utilizing this technical analysis basic concept will dramatically increase the potential of profits being produced in one’s portfolio. This is not difficult analysis. Candlestick analysis is the application of common sense investment practices put into graphic depiction.

Training Tutorial

Gap at the Bottom