Candlestick signals make analyzing stock market trading patterns relatively easy. Trading patterns become recognized because of the reoccurring mental processes of investor sentiment. Normal investor decision making is flawed with the input of emotion. The majority of investors are usually wrong. Human emotions are contrary to rational investment decision making. Being able to graphically analyze what investors normally do provides a huge advantage. Candlestick analysis is capturing and analyzing investor sentiment on a chart.

Western analysis has identified many reoccurring stock market trading patterns. Adding Candlestick signals to the analysis creates a huge advantage. Once recognizing that a trading pattern is developing, it can be better analyzed and more accurately timed when applying Candlestick signals. One of the most highly profitable stock market trading patterns is called a “Fry Pan Bottom”.

The Fry Pan Bottom pattern, once analyzed, is very easy to recognize and it is very easy to understand how it forms. This week’s online Candlestick training session on the site delved into the Fry Pan Bottom pattern. Understanding the ramifications of the psychology that forms the Fry Pan Bottom allows an investor to prepare for the potential of a high profit trade.

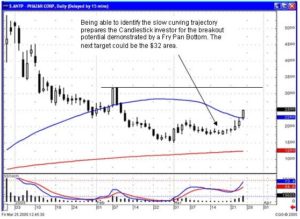

One of the recommendations this past week was Phazar Corp. (ANTP). The recommendation was based on recognizing the set-up for a Fry Pan Bottom. As illustrated in the ANTP chart, a Fry Pan Bottom was forming over the past three weeks. Being able to analyze the formation creates a fairly low risk trade and can be used in an aggressive trader’s strategy as well. Note how the downward trajectory was very slow, followed by a few days of indecisive trading, small Spinning Top signals, then a small Bullish Engulfing signal formed and was followed by a slow uptrend. This stock market trading pattern was occurring during a time when the indexes were in a steady downtrend.

ANTP

That slow bottoming action is the Fry Pan Bottom. It looks like the bottom of a frying pan. The psychology is simple to analyze. First, investors had a negative bias. That bias became neutral, then started slowly moving back to the upside, revealing the rebuilding of investor confidence. A conservative investor could have bought the stock after the first little Bullish Engulfing signal, knowing that the stop loss would have been any trading below the bottom of that bullish candle. A more aggressive trader would start buying as the candle formations started to enlarge, revealing that investor sentiment was dramatically building up confidence.

The result of a Fry Pan Bottom is that when it breaks out through the peak that started the downward trend, the force of the new confidence will move it to much higher levels. Does this work every time? Not every time, but the probabilities are extremely high. This is the type of knowledge that is easily obtained through Candlestick analysis. Once you understand the common sense logic of how the formation is created, the eye will become easily trained to identify this type of stock market trading pattern.

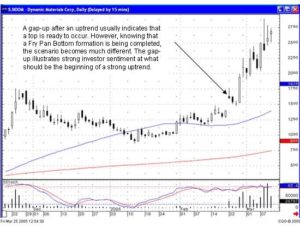

Boom

That is why we have been so successful in trading the BOOM stock this past month. The analysis becomes much easier once the pattern of its recent past trading is identified. Being able to identify the potential chart pattern that could develop, and using other technical indicators such as the moving averages, allows the refinement of the entry and exit strategies. In this case, BOOM was first bought back in mid-January on seeing the Morning Star signal. Its lackluster movement after that signal could be credited to the 50-day moving average. Once it broke through at the end of January, the 50-day moving average acted as support. But more importantly, the slow uptrend after the slow downtrend was now giving the implications that a Fry Pan Bottom was forming.