Analyzing the market trend is the first step for deciding the portfolio allocation. Candlestick signals make that analysis relatively simple. The same analysis involved in individual stocks can be applied to the market indexes in general. This is not a difficult process. Investor sentiment is illustrated in market index charts the same as they are in individual charts. Which direction is the overall trend? Applying the analysis with candlestick signals to both the Dow and the NASDAQ provide a tremendous insight during a market trend analysis.

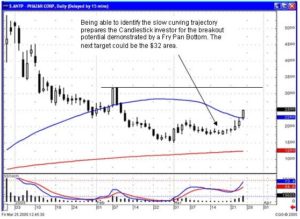

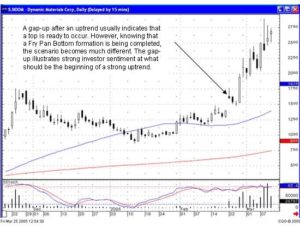

In any analyze, the candlestick signals are indicating at important technical levels produces a huge advantage for the candlestick investor. At technical levels such as trend lines or moving averages, having the ability to see exactly what investor sentiment is doing at those levels produces low risk entry and exit strategies. A major reversal signal forming right on a resistance level or a support level creates the opportunity to get into a trade at the optimal price level.

Entering a trade just as investor sentiment is reversing creates low risk stop loss procedures. If a candlestick buy signal is occurring at a major support level, a trend line, a recent previous low, or a major moving average, the stop loss analysis becomes relatively simple. Once the position is established based upon a candlestick signal at a major support level, the stop loss can be established at the point that negates the buy signal. Because the position can be established very early in the reversal cycle, the loss potential becomes very small. This establishes the investment strategy of being able to cut losses short. Review the training tutorial on Trend Analysis; the very same procedures Stephen Bigalow uses each day for analyzing the market trend.

Market direction – The moving averages have become an important factor in the price direction of the Dow. As illustrated last week, the trading at the 50 day moving average revealed great indecision. A bullish day followed by a bearish day, followed by a bullish day, followed by a bearish day. The large bearish candle last week in the Dow finally revealed which way the investor sentiment had turned.

Notice after three days of weakness, the 20 day moving average acted as a temporary support. For the aggressive trader, analyzing what type of signal was occurring on the one minute and five minute charts just as prices reached the 20 day moving average would have allowed for some short covering or some very quick long trades. However, the major moving averages, the 50 day moving average and the 200 day moving average still should be the important levels for trend analysis.

DOW

The 50 day moving average acted as the obvious resistance level for most of the prior two weeks of trading. The failure of that level meant the 200 day moving average would be the next likely support level. The important word in that statement is “likely.” As can be witnessed in Thursday’s trading, the 200 day moving average did not appear to act as any support. Stochastics still being in a downward direction make a lower target likely. The recent lows in June become the next likely target. Or the 500 day moving average might now come into play. Whenever an obvious technical level is breached, the level that everybody else was likely to be watching, then start looking for what would be the next likely target.

If both indexes are showing no obvious potential reversal signals, then the current trend is likely to continue until something changes overall investor sentiment. Although the NASDAQ chart is indicating that the stochastics are getting toward the oversold area, nothing yet has revealed that the investor sentiment is changing. This is not a difficult process for analyzing market trends. The Japanese Rice traders say to let the market tell you what the market is doing.