A “bull call spread” is the term for one of several stock option trading strategies. The bull call spread occurs when a modest increase in the price of the asset is expected. It is achieved by purchasing call options at a specific strike price while also selling the same number of calls of the same asset and expiration date but at a higher strike. The maximum profit in this strategy is the difference between the strike prices of the long and short options, less the net cost of options. Most of the time, a bull call spread is a vertical spread.

A bull call spread is a simple technique within the best option trading system. The bottom line of a bull call spread is that the investor is able to buy a stock at a lower price and in turn, sell at a higher price, thereby making a profit. In such a case, the stocks belong to the same company, but have different strike prices. This allows the wise investor to realize a profit by leveraging the varied strike prices against actual price of the stock.

For this example of a bull call spread, assume that a stock is trading at $28 and an investor has purchased one call option with a strike price of $30 and sold one call option with a strike price of $35. If the price of the stock jumps up to $45, the investor must provide 100 shares to the buyer of the short call at $35. This is where the purchased call option allows the trader to buy the shares at $30 and sell them for $35, rather than buying the shares at the market price of $45 and selling them for a loss. A bull call spread is used by successful traders to create a profit when a loss seems inevitable.

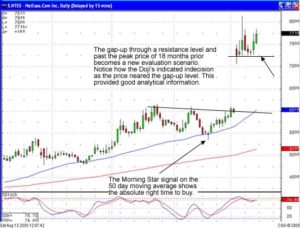

There are several factors to consider when utilizing a bull call spread. It is imperative to follow a well-designed stock trading plan and avoid the emotions of greed and fear. While this is a profitable technique, the bull call spread involves strike and call prices, as well as the typical monitoring of stock prices to be familiar with their movements. The easiest way to create a bull spread is to use a call option at, or near, the current market price. When buying the lower priced call and selling a higher priced one, a bull call spread has been created.

As with any technique in successful trading, the investor is obligated to do his, or her, part. It is necessary to perform stock technical analysis in order to understand the stability of the stock being purchased. It is also important to have a successful stock trading system such as candlestick chart analysis. While such a technique is a low-risk maneuver, even a beginner investing in options can be well equipped to negotiate a bull call spread.

Sometimes the difference between great traders and average traders are their instincts as well as their understanding stock market basics. A modest gain is always better than the most thrilling loss.