What are the successful trading characteristics of today’s successful traders?

Some people are very comfortable doing stock analysis and some are not. And just because you feel confident and comfortable trading stocks, it doesn’t necessarily mean you will be good at it. There are no hard and fast rules on what makes a successful stock trader, yet there are several characteristics that those who make the most amount of money in the least amount of time all have in common.

1. To be successful, a trader must be patient. A successful trader let’s winning positions run, but is able to swallow his pride and close the trade when it isn’t working. Patience means knowing how to be resilient, courageous, and disciplined when the markets go against you.

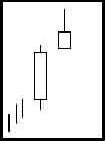

2. The exploration of stocks is a key ingredient to becoming a successful trader. Developing skill in both fundamental and technical analysis is suggested.

3. The successful trader is passionate and has a biting desire to succeed. The biting desire to succeed can make all the difference in educating yourself about what you want to know and sticking to your strategy when the going gets rough.

4. As they practice stock trading, potential embarrassment is not a concern with successful traders. They expect to have losses and know when to cut them as soon as they are recognized.

5. Successful traders are highly disciplined. Extremely disciplined. A successful trader does what needs to be done, even if he isn’t in the mood. Discipline also means sticking to your strategy, not suddenly buying or selling on a whim, or because of a” hot tip”.

6. Successful traders know that mistakes are going to happen. They realize and appreciate that the ability to make their own mistakes is a necessary part of the learning process.

7. A winning trader knows the difference between defensive and offensive behavior, and when to use each – protect your money first, profit later.

8. Successful traders balance their lives. Stock trading can be addicting, a successful trader can break away ‘at will’ before putting too much at risk.

9. Successful traders are risk adverse. They don’t like losing money and control themselves before losing a large quantity, even if they have to admit they made a mistake.

10. Getting emotionally involved or placing trades based on hunches or rumors are not characteristics of successful traders. To be victorious you have to be able to resist the urge to prove you are right and be ready to make mistakes. Greed and fear should not affect your decisions. Setting stop losses on every trade is something that promotes success in trading. This means that on more than one occasion, you will have to admit that you are wrong.

By using stop loss strategies correctly, your ego and your portfolio will survive and you may be able to get back into your “pet” position again when trends tell you it is the appropriate time to do so. You will have to learn to disregard any emotional ties you have to your stock and make quick stock trends your master. Although you might miss the lowest entry points and the top selling points, you will be able to sleep at night and look at yourself in the mirror in the morning. Learning to get out of a stock position before your profits turn to losses becomes a necessity. Learn solid stock investing concepts.