There are many important technical analysis tools tools – but The most important technical analysis tools are Japanese Candlestick Signals.

Ask yourself this question; How many important technical analysis tools have lasted for centuries? Hmmm, let me think, Japanese Candlesticks? Well, it certainly isn’t the latest trading craze bombarding your email inbox. The Japanese did not realize they would provide future generations with the most important technical analysis tools for the 21st Century.

Japanese Candlestick charting dramatically accelerates learning important technical analysis required to interepret stock charts. The education process is easy and you can be successfully trading in no time. Unlike confusing line charts, candlesticks provide a visual depiction for reversals, trends or continuation periods. Successful trading can begin with the 12 Major Signals alone!

Join us, as we educate investors around the world to trade using the most important technical analysis tools available. Learn the 12 Major Signals, the Reversal Signals, and Continuation Patterns. Don’t forget to join Stephen W. Bigalow every Thursday evening for his free stock chat sessions.

This article introduces the “On Neck Line” a Bearish Continuation Pattern

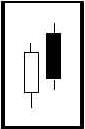

ON NECK LINE

(ate kubi)

Description

The On Neck Line pattern is almost a ‘meeting line pattern’, but the critical term is ‘almost’. The ON Neck pattern does not reach the previous day’s close; it only reaches the previous day’s low.

Criteria

- A long black candle forms in a downtrend.

- The next day gaps down from the previous day’s close; howver, the body is usally smaller than one seen in the meeting line pattern.

- The second day closes at the low of the previous day.

Pattern Psychology

After a market has been moving in a downward direction, a long black candle enhances the downtrend. The next day opens lower, a small gap down, but the trend is halted by a move back up to the previous day’s low. The buyers in this up move should be uncomfortable that there was not more strength in the up move. The sellers step back in the next day to continue the downtrend.

These unique Flash Cards will allow you to be “trading like the Pro’s” in no time.