Over the past 10 years, the number of stock trading methods that have been revealed on the Internet has exploded. Everybody promotes their stock trading methods that are reported to have been working. It seems surprising that these stock trading methods didn’t seem to be around before the internet showed up.

There are always the fantastic claims about the returns that these stock trading methods are producing. Yet you never find anybody that has been participating in these fantastic returns. That becomes another learning process in most investor’s investment education. The one basic rule, in regards to investing, is that when you find something that works consistently, continue to use it and try to improve upon it.

Candlestick analysis investing is most tested and proven investment methodology. It has been in existence for hundreds the years. The one predominant point that is demonstrated on the Candlestick Forum site is that the candlestick patterns put the probabilities of being in a correct trade highly in your favor. Are you going to get rich quick with candlestick signals? Are you going to make money on every single trade you do with candlesticks? Probably not! But you will have the opportunity to use a stock trading method as a framework for producing consistent profits. The common-sense rationale that is used for forming the signals allows you to develop investment strategies that can implement new computer-technology processes and/or establish optimal timing strategies for fundamental research recommendations.

When you learn how to utilize the candlestick signals correctly, you now have the knowledge that will improve your trading techniques for whatever trading entities you want to trade. You do not have to depend on canned programs that sometimes work and sometimes don’t work. You do not have to buy or sell stock recommendations blindly when a research analyst recommends a stock. The candlestick signals give you guidance as to what investors are actually doing at that point in time. There is something in the dynamics of Candlesticks. Learn them and your investments perceptions will be improved for the rest of your life. Utilizing candlestick charts will greatly improve your analytical abilities

Market Direction

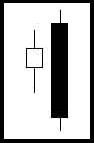

The NASDAQ had a hard time getting through the 50 day moving average. At the same time, Thursday, the DOW did a bearish engulfing signal. Thursday confirmed the selling after they’d tried to push it up through the 50 day moving average one more time in the Nasdaq. The lower open on Friday confirmed the selling, or the lack of buying at the 50 day moving average area. The stochastics also were starting to turnover in the overbought area.

NASDAQ

Note how the Doji just touched the 200 day moving average, showing weakness at an important level. Also notice how the Doji/Harami revealed the buying starting five days earlier. Again, this is to illustrate that when you see a Candlestick signal at an important technical level, this acts as an additional confirmation that something important has occurred at those levels when combined with a Candlestick signal.

As you have seen in the “morning comments” and more specifically in the member “market comments”, it has been recommended for the past few days to be taking profits in the weak “long” positions and start adding to the short positions. This was nothing more than witnessing potential candlesticks sell signals occurring at important resistance levels. Over the past few days, a portfolio would have been shifting from being predominantly long, equally balanced, and then predominantly short. This makes moving with the trends an easy process.