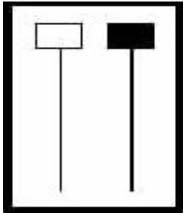

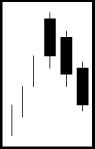

Stock option trading strategies require one basic element. Which direction is the underlying stock going to move. Most stock option trading strategies involve understandable implementation but they do not address the most important element of investing. Is the trading entity moving up, down or sideways. To apply stock option trading strategies successfully, an investor needs to know what direction the stock price is going to move and in what magnitude. Candlestick signals provide the basis for this information.

The most powerful aspect of candlestick signals is that they provide a very strong directional evaluation. Correct stock option trading strategies is the optimal way to use the information provided by candlestick analysis. The important word in a statement is “correct” stock option trading strategies. There are many places that promote option trading. However, there are very few that promote stock option trading strategies correctly. Have you heard of people telling how they spent big dollars on a stock option trading program but they do not quite get it. Then they are willing to spend more big bucks to go to the next step so they can understand what they have already learned. After that, they need to spend more money to again figure out what they have been taught. By this time, they spent $15,000 on stock option trading strategies that they don’t yet seem to fully understand. Observe the obvious; options strategies are not that difficult. Learning how to use stock option trading strategies correctly should be a concise and non-costly process. If somebody is having to continually spend more money to understand option trading, then that option trading program is not teaching the correct option trading methods.

This past month, Mr. Bigalow, along with four other investment speakers participated in a cruise, the Seminar at Sea. The purpose for the itinerary on this cruise was to give investors the array of investment strategies that can identify price direction. A candlestick signal is the primary facet of price direction analysis. Other speakers such as David Elliott of WallStreetteachers.com, a leading expert on technical analysis, and John Person, one of the leading experts on pivot points, provided additional valuable information on how to identify the trend direction and the magnitude of that trend. The combination of this education gave investors a number of investment techniques that they could apply to their own investment styles. Bill Johnson, author of numerous books on stock option trading strategies and Ron Ianiori, an actual ‘on the floor’ options trader provided the correct formulas for how to use option trading properly. Each speaker spoke right to the core of their investment strategies. The information provided from price direction analysis was many-fold greater than the participants ever imagined. Investors from all over the world responded that they were overwhelmed with the amount of valuable information they got from the speakers.

The stock option trading strategies became clear to them. Ron Ianiori cut to the chafe. The methods he demonstrated for utilizing options strategies correctly and clearly indicated his expertise in that field. It also illustrated how most other stock option trading strategy courses did not address the fine-points required to consistently maintain profitable option trades. If you are serious about learning option trading, then do it the right way. Learn from a floor expert. Learn option trading correctly the first time and you would not need the expense of follow-up courses to clarify what you should have previously learned. The Candlestick Forum recommends the Options University training program above all others.