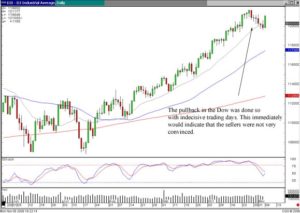

Daily Stock Market Comments

Get Your FREE Daily Stock Market Report.

Read Mr. Bigalow’s market comments every day to know where the stock market is heading!

Steve’s Trading Diary

The information in this section contains the unedited thoughts and musings of a professional Candlestick trading expert, Steve Bigalow, as he goes about his daily Candlestick analysis in search of great trades.

The follow-ups on the daily stock picks displayed here are limited to only the closed or unexecuted trades for previous months. To see the current follow-ups on the open trades, you must be a member of the Candlestick Trading Forum’s paid subscription service.