Why trade alone when you can chat with fellow traders AND Stepehn Bigalow LIVE? See, hear and discuss everything from individual stocks, breaking market news, new trading techniques and hot stocks on the move.

Join this fast growing community of active traders. Each day members exchange ideas, share hot stock picks, new trading strategies and enjoy the comradery of fellow traders. Your questions are always welcome in this interactive trading community.

Doesn’t it get a bit boring, trading in front of the computer all day?

Join the Candlestick Chat Community.

Exchange ideas! Share hot stock moves! Accelerate your learning process!

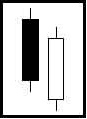

Wouldn’t you like to get explanations and recommendations when viewing Candlestick chart patterns?

View a sneak peek of the Member Trading Room