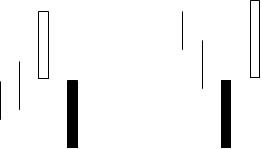

Knowing commodity market history allows us to know what the commodities markets will do next. Whether you are buying stock, trading options, selling futures, or trading commodities, knowledge of market history is essential. Trading software has market history built into its programs. Thus commodity traders who are trading online can do simulation trading with real commodity market conditions. More to the point keeping track of commodity market history goes back as far as when were new. Traders kept track of what happened when certain Candlestick chart formations developed. The use of technical analysis tools such as Candlestick charting allows traders to predict market moves using market history. A good way to learn to use technical analysis based on commodity market history to your advantage is to take commodity and futures training.

The reason traders keep track of commodity market history is that this history repeats itself. Thus patterns, such as Candlestick pattern formations, are predictive of continuing market trends or market reversal. Although a trader may be steeped in fundamental analysis of a commodity he or she still needs to be attuned to technical analysis indicators because these predict the actions of large groups of traders in live market conditions. There really is a déjà vu character to what is essentially trading using commodity market history as a guide. When true market history is packaged and schematized the trader should not forget that those neat little figures on the chart are really representations of many trading sessions in many commodities. They are predictors of how real traders, in groups, will react to market conditions and to each other to create the next state of trading in commodities.

In trading commodities you can buy and sell futures on everything from gold and copper to live cattle or interest rates. You can also trade options. The distillation of commodity market history in Candlestick chart patterns will help with selling puts, selling calls, buying puts, and buying calls on commodities futures just as much as it helps trading futures directly. The presence of a sufficient number of traders in a sufficiently volatile market will end up creating patterns as traders react to fundamentals of the market as to each other’s trades. Although each trader will do fundamental commodity analysis as well as analysis of technical factors, the fact that one trade is entered at a time changes the market ever so slightly with each trade. Thus all traders minus one are confronted with a slightly different situation. As trades are executed the market changes, traders reevaluate, change tactics, and patterns develop.

The wise trader will always use trading analysis tools and be mindful of the fact that history continually repeats itself on a commodities exchange. It is this realization that every day creates market history and that history repeats itself in the form of recognizable price patterns that gives the wise trader an advantage. This is what Japanese rice traders realized centuries ago. The use of Candlestick charting techniques gave these traders an edge on those who only looked at market fundamentals.

Today’s whipsaw action in the market was partly due to the heavy selling that was actually occurring but then an electronic anomaly set in. Probably the lower 400 or 500 points in the Dow was a result of electronic trading. The New York Stock Exchange has the discretion of stopping trading in individual stocks that are getting overloaded for anywhere from 30 seconds to 90 seconds. However, the rest of the electronic exchanges are still active but if they are thinly traded exchanges, an electronic sell order trying to find the best bid price may hit one of these secondary markets at much lower prices.

DOW

Whatever the conditions, the candlestick signals were indicating selling was on its way. The sell signals last week at the tee line indicated a definite change of investor sentiment. The whipsaw trading of last week was an indication a severe change of investor sentiment was occurring. The Dow and the NASDAQ had the possibility of supporting at the 50 day moving average today but continued weakness breach that level with great enthusiasm. As the selling continued, panic selling started to set in. Although the Dow being down 900+ points was probably not a true indication of where the markets should be trading, the 347 point move in the Dow was still relatively substantial. This was what the bearish signals revealed last week. A bearish pull back was in the making.

Obviously there would not be any feelings of anxiety you were situated correctly in the market. There is a great sense of pleasure being short when the market is heading down. It is a Double Mint pleasure. First, it feels very good to watch the profits grow as prices are going down. Secondly, it feels that much better knowing the pain of what it feels like to be long when prices are going down and you are not having to experience it. Most investors are optimists. They want the market to go up. That is only human nature. When prices are going up, everything seems to be improving. It is harder to make money when the market is moving down. A large percentage of investors do not like or understand shorting stocks. Buying the short funds seems to be a comfortable alternative.

BGZ Short Fund

Candlestick analysis provides the investor with the tools they need. Candlestick signals show the direction of the market in general. That analysis can be continued to individual sectors, then on to individual stocks. This is the alignment of the stars. The information built into the candlestick signals allows investors to participate on the correct side of the market. What would have been an anguish filled day for most investors was an exuberant, highly profitable day for the candlestick investor.

Commodity traders

A two day training program is now scheduled for May 22 and May 23. You will learn numerous techniques to take advantage of what candlestick signals reveal for intraday trading and swing trading of commodities and currencies. This two day online training program will expose you to an immense amount of profitable information. Commodity trading using candlestick signals can be extremely profitable. What is considered a high risk trading venue now becomes a high profit venue. There are many advantages to trading commodities. If you are a true traitor, you can be trading stocks at the beginning and the end of each day while trading commodities during the slow middle part of the day. Spaces will be limited. Look for details on the home page over the weekend.

Chat session tonight at 8 PM ET – learn how to have made huge profits on days like today.

Projecting Price Targets – Quickly learn to spot the most profitable price targets! – BONUS EBOOK with purchase!!!

Website special reflects current newsletter. If you are reading an archived newsletter you will be directed to Current Website Special.