The Seven Deadly Sins of Option Trading – Free E-Book Download

Recommended Option Training Materials

How To Trade The Major Candlestick Signals

HOW TO TRADE THE DOJI SIGNAL

HOW TO TRADE THE BULLISH ENGULFING SIGNAL

HOW TO TRADE THE BEARISH ENGULFING SIGNAL

HOW TO TRADE THE HAMMER SIGNAL

HOW TO TRADE THE HANGING MAN SIGNAL

HOW TO TRADE THE PIERCING PATTERN

HOW TO TRADE THE DARK CLOUD SIGNAL

HOW TO TRADE THE BULLISH HARAMI

HOW TO TRADE THE BEARISH HARAMI

HOW TO TRADE THE MORNING STAR

HOW TO TRADE THE EVENING STAR

HOW TO TRADE THE KICKER SIGNAL

HOW TO TRADE THE SHOOTING STAR

HOW TO TRADE THE INVERTED HAMMER

Learning About the Stock Market Using The Hammer Signal

Learning about the stock market for personal stock market investing can be very costly if not approached in the right manner. Attributes built into candlestick charts greatly reduce the potential of losses while learning about the stock market. The knowledge conveyed in just one of the 12 major signals helps investors understand the dynamics of what makes price move. This is true for investors that are just learning about the stock market all the way up to experienced traders. The candlestick charts are in use today because they have worked effectively throughout the centuries. Japanese Rice traders recognized that investor sentiment operates in reoccurring patterns. They recognized candlestick charts provided patterns that would reoccur as a trend was about ready to reverse. This became valuable information. The psychological elements that are incorporated into the major candlestick signals makes learning about the stock market easier and more profitable.

Out of a universe of 50 to 60 candlestick reversal signals, it has been found that only 12 of the signals require attention. These 12 major signals will provide more trade situations than most investors will be able to utilize. The insights gained from dissecting each of the 12 major signals becomes a valuable tool for learning about the stock market. The common complaint for most investors learning to read candlestick charts was there were too many candlestick signals. When learning the stock market, an investor wants a proven investment technique.

andlestick charts produces a very strong trading platform the candlestick signals have proven themselves to work. The question is not whether they work or not, the question is whether somebody can learn how to use them correctly. The Candlestick Forum is a stock market education site that takes candlestick charts and individual candlestick signals and reduces the information down to the basic elements. If each signal is dissected and studied, the information that the signal conveys will become a powerful investment tool for the rest of your life. The knowledge presented in Candlestick Charts makes learning the stock market, or any other trading market, much easier to understand. Each signal provides an immense amount of information.

One of the most visually compelling signals is the Hammer signal. The hammer signal is easily recognized by the lower shadow ( the tail ) protruding to the downside after an extended downtrend.

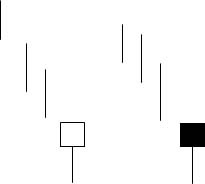

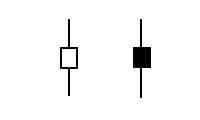

HAMMERS AND HANGING MAN

Description

The Hammer is comprised of one candle. It is easily identified by the presence of a small body with a shadow at least two times greater than the body. Found at the bottom of a downtrend, this shows evidence that the bulls started to step in. The color of the small body is not important but a white candle has slightly more bullish implications than the black body. A positive day is required the following day to confirm this signal.

Criteria

- The lower shadow should be at least two times the length of the body.

- The real body is at the upper end of the trading range. The color of the body is not important although a white body should have slightly more bullish implications.

- There should be no upper shadow or a very small upper shadow.

- The following day needs to confirm the Hammer signal with a strong bullish

day.

Signal Enhancements

- The longer the lower shadow, the higher the potential of a reversal occurring.

- A gap down from the previous day’s close sets up for a stronger reversal move provided the day after the Hammer signal opens higher.

- Large volume on the Hammer day increases the chances that a blow off day has occurred.

Pattern Psychology

After a downtrend has been in effect, the atmosphere is very bearish. The price opens and starts to trade lower. The bears are still in control. The bulls then step in. They start bringing the price back up towards the top of the trading range. This creates a small body with a large lower shadow. This represents that the bears could not maintain control. The long lower shadow now has the bears questioning whether the decline is still intact. A higher open the next day would confirm that the bulls had taken control.

Training Tutorials

The Major Signals Educational Package has over 8 Hours of training for trading Candlestick Signals or The Hammer individual training video available for Quick Download.

Candlestick Forum Flash Cards These unique Flash Cards will allow you to be “trading like the Pro’s” in no time.

You Can Now Make Huge Profits From the Most Tested and Researched Investment Methodology in Recorded History – Japanese Candlestick Trading

NOT from well-kept investment “secrets”

NOT from “new” sophisticated formulas that promise amazing profits.

You can learn how to make huge and consistent profits from the world’s most proven and successful trading technique. Candlestick trading has compelling results.

Backed by a mountain of scientific research – and proven results for thousands of investors – the candlestick trading methods taught on this site will improve your investment results faster and with less effort than you ever dreamed possible!

Young, old, male, female, new at investing or a sophisticated trader, everybody can dramatically improve their investment returns using simple Japanese Candlestick analysis. If you can see, you can learn candlestick trading. Candlestick signals provide invaluable insights into the direction of a trend.

Review the chart of SeaChange Intl. below. This candlestick formation is called a Bullish Engulfing pattern. It appears at a point that stochastics indicate this stock is oversold. It is a candlestick signal that indicates a major reversal. It visually illustrates when to start buying this stock. No interpretation of trend lines, no calculation of difficult formulas. Just simple visual recognition of a Japanese Candlestick buy signal. Candlestick investing is simple visual identification.

The accuracy found in the Japanese Candlestick signals produces amazing results not found in any other investment method. The Candlestick Forum has developed techniques to take advantage of the information conveyed by the signals. On this site, you will learn.

- How to pinpoint profitable candlestick trades, with the most upside potential and the least downside risk.

- Fast and easy methods for remembering the most effective candlestick signal formations.

- How to weed out false candlestick signals.

- Money management techniques that completely eliminate emotional decisions.

- Breakthrough concepts that expand your wealth in quantum leaps, with very little downside risk.

- Powerful candlestick techniques that compound returns to astronomical heights.

- How the common investor’s investment psyche operates and how the Japanese Candlestick signals point out the profits that can be made from that flawed psyche.

- Potent candlestick trading insights that nail the tops and bottoms of trends.

Hello! My name is Steve Bigalow, and for 25 years, I have searched for the “Holy Grail” to consistent investment profits. Name any investment technique ever invented and I have probably tried it. Then, a little over 15 years ago, I discovered Japanese Candlesticks. For the past 15 years, I have developed and refined techniques using the Japanese Candlesticks to consistently pull profits from any kind of market. Bull or bear, stocks, commodities, or tulip bulbs, it doesn’t matter. All you need to know is how to recognize the easily-seen signals the Japanese Candlesticks create.

My program will accelerate your investment knowledge and net wealth in ways that will absolutely amaze you.

PCF (Personal Criteria Formulas) For TeleChart Software

PCF’s written in TeleChart searches for The Major Candlestick Signals

The following criteria for Major Candlestick Signals is provided for your convenience. Follow TeleChart instructions for adding search criteria, then ‘cut-and-paste’ the formulas below.

You will also find these posted in the Candlestick Forum club on TeleChart. Join Steve and fellow candlestick traders by adding the Candlestick Forum club to your directory.

Doji

(O = C )

Doji Yesterday

(O1 = C1 )

Doji and Near Doji

(ABS(O – C ) <= ((H – L ) * 0.1))

Bullish Engulfing

((O1 > C1) AND (C > O) AND (C >= O1) AND (C1 >= O) AND ((C – O) > (O1 – C1)))

Bearish Engulfing

((C1 > O1) AND (O > C) AND (O >= C1) AND (O1 >= C) AND ((O – C) > (C1 – O1)))

Hammer

(((H-L)>3*(O-C)AND((C-L)/(.001+H-L)>0.6)AND((O-L)/(.001+H-L)>0.6)))

Hanging Man

(((H – L) > 4 * (O – C)) AND ((C – L) / (.001 + H – L) >= 0.75) AND ((O – L) / (.001 + H – L) >= .075)))

Piercing Line

((C1 < O1) AND (((O1 + C1) / 2) < C) AND (O < C) AND (O < C1) AND (C < O1) AND ((C – O) / (.001 + (H – L)) > 0.6))

Dark Cloud

((C1 > O1) AND (((C1 + O1) / 2) > C) AND (O > C) AND (O > C1) AND (C > O1) AND ((O – C) / (.001 + (H – L)) > .6))

Bullish Harami

((O1 > C1) AND (C > O) AND (C <= O1) AND (C1 <= O) AND ((C – O) < (O1 – C1)))

Bearish Harami

((C1 > O1) AND (O > C) AND (O <= C1) AND (O1 <= C) AND ((O – C) < (C1 – O1)))

Morning Star

((O2>C2)AND((O2-C2)/(.001+H2-L2)>.6)AND(C2>O1)AND(O1>C1)AND((H1-L1)>(3*(C1-O1)))AND(C>O)AND(O>O1))

Evening Star

((C2 > O2) AND ((C2 – O2) / (.001 + H2 – L2) > .6) AND (C2 < O1) AND (C1 > O1) AND ((H1 – L1) > (3 * (C1 – O1))) AND (O > C) AND (O < O1))

Bullish Kicker

(O1 > C1) AND (O >= O1) AND (C > O)

Bearish Kicker

(O1 < C1) AND (O <= O1) AND (C <= O)

Shooting Star

(((H – L) > 4 * (O – C)) AND ((H – C) / (.001 + H – L) >= 0.75) AND ((H – O) / (.001 + H – L) >= 0.75)))

Inverted Hammer

(((H – L) > 3 * (O – C)) AND ((H – C) / (.001 + H – L) > 0.6) AND ((H – O) / (.001 + H – L) > 0.6)))

Recent Formulas Submitted by our Candlestick Forum Members

These have not been tested by the CandlestickForum

J-Hook Pattern

((L1 = MINL4) OR (L2 = MINL4) OR (L3 = MINL4) ) AND

( (MAXC3 < MAXC4.3)) AND

( (H3 = MAXH15.4) OR (H4 = MAXH15.4) OR (H5 = MAXH15.4) OR (H6 = MAXH15.4) OR (H7 = MAXH15.4) ) AND (((MAXH4.3 – MINL4) / (MAXH4.3 – MINL21.3) > .23) AND ((MAXH4.3 – MINL4) / (MAXH4.3 – MINL21.3) < .62) ) AND

((AVGH3.5) > (AVGH3.8 ) AND (AVGH3.8 ) > (AVGH3.13) AND (AVGH3.13) > (AVGH3.18 ))

Belt Hold

C > O

AND L = MINL10

AND ((C – O) / (H – L)) > .5

AND ((C1 – L) / (H – L) > .6)

AND (H – L) > .2 * ((H5 – L5) + (H4 – L4) + (H3 – L3) + (H2 – L2) + (H1 – L1))

AND H > L1 AND C < H1

Belt Hold

(C > O) AND (H > L1) AND (L = MINL10) AND

((C – O) / (H – L) > .5) AND

(ABS(C1 – L) / (H – L) > .5) AND

( (H – L) > (((H – L + ABS(C1 – H) + ABS(C1 – L)) / 2 + (H1 – L1 + ABS(C2 – H1) + ABS(C2 – L1)) / 2 + (H2 – L2 + ABS(C3 – H2) + ABS(C3 – L2)) / 2 + (H3 – L3 + ABS(C4 – H3) + ABS(C4 – L3)) / 2 + (H4 – L4 + ABS(C5 – H4) + ABS(C5 – L4)) / 2) / 5))

Three Outside Down Pattern

((C2>O2)AND(O1>C1)AND(O1>=C2)AND(O2>=C1)AND((O1-C1)>(C2-O2))AND(O>C) AND (C

Three Outside Up Pattern

((O2>C2)AND(C1>O1)AND(C1>=O2)AND(C2>=O1)AND((C1-O1)>(O2-C2))AND (C>O)AND (C>C1))

Three Inside Up Pattern

((O2>C2)AND(C1>O1)AND(C1<=O2)AND(C2<=O1)AND((C1-O1)<(O2-C2))AND(C>O)AND(C>C1)AND(O>O1))

Three Inside Down Pattern

((C2>O2)AND(O1>C1)AND(O1<=C2)AND(O2<=C1)AND

((O1-C1)<(C2-O2))AND(O>C)AND(C>C1)AND (O< p=””><>

Three White Soldiers PCF

(C>O*1.01) AND(C1>O1*1.01) AND(C2>O2*1.01) AND(C>C1) AND

(C1>C2) AND(OO1) AND(O1O2) AND

(((H-C)/(H-L))<.2) AND(((H1-C1)/(H1-L1))<.2)AND(((H2-C2)/(H2-L2))<.2)

Three Black Crows PCF

(O > C * 1.01) AND (O1 > C1 * 1.01) AND (O2 > C2 *

1.01) AND (C < C1) AND (C1 < C2) AND (O > C1) AND (O < O1) AND

(O1 > C2) AND (O1 < O2) AND (((C – L) / (H – L)) < .2) AND

(((C1 – L1) / (H1 – L1)) < .2) AND (((C2 – L2) / (H2 – L2)) < .2)

SIMPLE MOVING AVERAGE SCANS

Crossing Up Through 50SMA (you may replace the 50 with other MA’s)

AVGC50 <= H AND AVGC50 >= L

Price under 50 Moving Average Yesterday – Over 50 Moving Average Today

C > AVGC50 AND C1< AVGC50

Bounce off 50MA Yesterday

AVGC 50.1 <= H AND AVGC50.1 >= L AND C > C1 AND C > AVGC50

Price Crossing over the 50MA and 20MA Today

(C > AVGC50 AND AVGC20 ) AND (C1 < AVGC50.1 AND AVGC20.1 )

Crossing Up Through 200SMA

AVGC200<=H AND AVGC200>=L

Stochastics Moving Up Through 20

STOC12.3.1 < 20 AND STOC12.3 > 20

April 2007 -New Formulas submitted by fellow Candlestick Forum Members for TeleChart Users

Thanks to everyone who emails their formulas on Candlestick Personal Criteria Formulas. These are not tested by us and provided as a courtesy. Please contact the Worden Brothers at Telechart2007 for all pcf support.

BULLISH PATTERNS

Abandoned Baby

C2

H1>L2 AND

(C1+O1)/2>=((H1+L1)/2)*0.40 AND

(C1+O1)/2<=((H1+L1)/2)*0.60 AND

ABS(C1-O1)<= (H1-L1)*10 AND

L>H1 AND

C

*Sort in ascending order*

Breakaway

C4

C3

C>O AND

C>H3

*Sort in ascending order*

Concealing Baby Swallow

O3=H3 AND

C3=L3 AND

O2=H2 AND

C2=L2 AND

C1

O=H AND

C=L AND

H>H1 AND

L

*Sort in ascending order*

Doji Star

C1

L>H1 AND

ABS(C-O)<= (H-L)*0.05 AND

((C+O)/2)-L >= (H-L)*0.40 AND

((C+O)/2)-L <= (H-L)*0.60

*Sort in ascending order*

Hammer/Dragonfly Doji

((((CO)*O))*(-1))-L>=(H-L)*0.75 AND

(H-L)>(AVGH21-AVGL21)

*Sort in ascending order*

Harami Cross

ABS(C1-O1)>(H1-L1)*0.50 AND

C1

(((C+O)/2)-L) > (H-L)*0.40 AND

(((C+O)/2)-L) < (H-L)*0.60 AND

ABS(C-O) < (H-L)*0.20

*Sort in ascending order*

Homing Pigeon

C1

ABS(C1-O1)>(H1-L1)*0.50 AND

H

C

*Sort in ascending order*

Inverted Hammer/Gravestone Doji

ABS(C-O) <= (H-L)*0.25 AND

((C+O)/2) – L <= (H-L)*0.25 AND

H-((C+O)/2)>= (((C+O)/2)-L)*0.34

Ladder Bottom

O4>C4 AND

O3

C>O AND

O>O1

*Sort in ascending order*

Mat Hold

C4>O4 AND

ABS(C4-O4)>(H4-L4)*0.50 AND

C3

C2>L4 AND

C1>L4 AND

C>C4 AND

C>O AND

(H-L)>(AVGH21-AVGL21) AND

C2

ABS(C2-O2)<= ABS(C4-O4)*0.75 AND

ABS(C2-O2)<= ABS(C4-O4)*0.75

*Sort in descending order*

Matching Low

(C1ABS(C1-O1)>(H1-L1)*0.50 AND

C

*Sort in ascending order*

Meeting Lines

C1

O1

CC>C1*0.99

*Sort in ascending order*

Rising Three Methods

(C4>O4) AND

(H4-L4)>(AVGH21.4-AVGL21.4) AND

C2

ABS(C3-O3)<=ABS(C4-O4)*0.75 AND

ABS(C2-O2)<= ABS(C4-O4)*0.75 AND

ABS(C2-O2)<= ABS(C4-O4)*0.75 AND

C>O AND

(H-L)>(AVGH21-AVGL21) AND

C>C4

*Sort in descending order*

Stick Sandwich

C2

L1>C2 AND

C

C

*Sort in ascending order*

Three Inside Up

ABS(C1-O1) >= (H2-L2)*0.70 AND

ABS(C2-O2)>(H2-L2)*0.50 AND

C1>O1 AND

C2

C>O AND

C>C1

*Sort in ascending order*

Three Outside Up

ABS(C2-O2)>(H2-L2)*0.50 AND

C2

O1

C>C1

*Sort in ascending order*

Tweezer Bottom

L=L1 AND

ABS(C-O)ABS(C1-O1)>=(H1-L1)*0.90 AND

(H1-L1)>=(AVGH20-AVHL20)*1.3

*Sort in ascending order*

BEARISH PATTERNS

Advance Block

(H-L)>(AVGH21-AVGL21) AND

ABS(C1-O1)>(H1-L1)*0.50 AND

ABS(C2-O2)>(H2-L2)*0.50 AND

C>C1 AND

C1>C2 AND

O1> O2 AND

O1< C2 AND

O>O1 AND

O

(H1-L1) < (H2-L2)*0.80 AND

(H-C)>(O-L) AND

(H1-C1)>(O1-L1)

*Sort in descending order*

Belt Hold

C>O AND

C>H*0.98

*Sort in descending order*

Breakaway

ABS(C4-O4)>(H4-L4)*0.50 AND

C4>O4 AND

C3>O3 AND

L3>H4 AND

C2>C3 AND

C1>C2 AND

C

*Sort in descending order*

Dark Cloud Cover

ABS(C1-O1)>(H1-L1)*0.50 AND

C1>O1 AND

O>H1 AND

C<((C1+O1)/2) AND

C>O1

*Sort in descending order*

Deliberation

ABS(C2-O2)>(H2-L2)*0.50 AND

ABS(C1-O1)>(H1-L1)*0.50 AND

C1>C2 AND

C2>O2 AND

C1>O1 AND

O>H1 AND

(((C+O)/2)-L) > (H-L)*0.40 AND

(((C+O)/2)-L)<(H-L)*0.60 AND

ABS(C-O)<(H-L)*0.60

*Sort in descending order*

Doji Star

ABS(C1-O1)>(H1-L1)*0.50 AND

O>C1 AND

ABS(C-O)<(H-L)*0.05 AND

(H-L)<(AVGH21-AVGL21)*0.20

*Sort in descending order*

Dragonfly Doji/Hanging Man

(((C<=O)*O)+ ((C>O)*C))>(H*0.95) AND

((((C<=O)*C)+ ((C>O)*O)) – L) > (H-L)*0.75

*Sort in descending order*

Engulfing

C1>O1 AND

C1

*Sort in descending order*

Evening Doji Star

ABS(C2-O2)>(H-L)*0.50 AND

C2>O2 AND

ABS(C1-O1)<(H1-L1)*0.05 AND

(H1-L1)<(AVGH21.1-AVGL21.1)*0.20 AND

O1>C2 AND

C

*Sort in descending order*

Falling Three Methods

ABS(C4-O4)>(H4-L4)*0.50 AND

C4

H3<=H4 AND

L2>=L4 AND

H2<=H4 AND

L1>=L4 AND

H1<=H4 AND

H2>H3 AND

H1>H2 AND

C

*Sort in descending order*

Grave Stone Doji/Shooting Star

ABS(C-O)<(H-L)*0.33 AND

O>C1 AND ((C+O)/2)-L<(H-L)*0.4 AND H=MAXH10

*Sort in descending order*

Hanging Man

(((C<=O)*C)+ ((C>O)*O))-L)>=ABS(C-O)*2 AND

(((C+O)/2)-L)> (H-((C+O)/2))*2 AND

ABS(C-O)>.01

*Sort in descending order*

Identical Three Crows

C2

O1=C2

*Sort in descending order*

In Neck

ABS(C1-O1)>(H1-L1)*0.50 AND

C1

(C/C1)<1.05

*Sort in ascending order*

Meeting Lines

C1

O1

CC>C1*0.99

*Sort in ascending order*

Three Black Crows

O1

O

C1

*Sort in descending order*

Three Inside Down

ABS(C2-O2)>(H1-L1)*0.50 AND

C2>O2 AND

C1

C

*Sort in descending order*

Three Line Strike

C2>C3 AND

C1>C2 AND

(H3-L3)> (AVGH21.3-AVGL21.3) AND

(H2-L2)> (AVGH21.2-AVGL21.2) AND

(H1-L1)> (AVGH21.1-AVGL21.1) AND

O>O3 AND

C

*Sort in descending order*

Three Outside Down

C2>O2 AND

C2

C

*Sort in descending order*

Tweezer Top

H=H1 AND

ABS(C-O)ABS(C1-O1)>=(H1-L1)*0.90 AND

(H1-L1)>=(AVGH20-AVHL20)*1.3

*Sort in descending order*

Upside Gap Two Crows

ABS(C2-O2)>(H2-L2)*0.50 AND

C2>O2 AND

L1>H2 AND

C1

C

*Sort in descending order*

Paper Trading Futures – Getting Your Thoughts Down on Paper

![]()

Don’t you love just throwing away money? Oh, not one of your favorite things? Well, most people feel the same way so jumping into something like futures trading is pretty scary. The good news is that you can learn by throwing away some virtual money and not the real stuff with something called paper trading futures. Thanks to the wonderful world of the Internet, paper trading futures is an easy, free way to simulate futures trading without the financial risk. Before we go deeper into paper trading futures, let’s talk about futures trading in general.

Futures trading is different from investing in the stock market or bonds since you don’t actually own anything; in futures trading, you are speculating on the future direction of the price in the commodity you are trading. This is like a bet on future price direction. The terms “buy” and “sell” merely indicate the direction you expect future prices will take. He or she must only deposit sufficient capital with a brokerage firm to insure that he will be able to pay the losses if his trades lose money. (Notice the words “pay the losses”. When paper trading futures, you can ignore those nasty words!)

Futures trading is a sort of insurance plan for those who are trading and investing. A farmer may sell futures on his wheat crop if he thinks the price will go down before the harvest; conversely, a bread manufacturer may buy futures if they think the price of wheat is going to rise before the harvest. Regardless of the price movement, both are guaranteed their price. The final component of the equation is the investor in futures trading who looks for changes in the futures markets and seeks to gain advantages by buying or selling at a profit.

The Potential of Futures Trading

Trading futures is an excellent way to make money. It is said that Richard Dennis, a famed commodities trader, was able to parlay $1,600 of borrowed money into $200 million over ten years. Futures trading has a bad reputation as being filled with risk and while there is risk; the truth is that futures trading is only as risky as a trader makes it. This is not the lottery or a trip to the casino; if you take a conservative approach, look for a reasonable return and make this a business then the probability of success in commodity trading is very good. The downside of paper trading futures is that even if you amass a $200 million fortune, you can’t collect it. Remember we’re just learning while paper trading futures…you can spend real money when you open a commodities account!

Getting Started Paper Trading Futures

There are a large number of companies on the Internet that offer free paper trading; a simple Google search will give you more choices that you can imagine. These companies offer this service in hopes that after you get comfortable paper trading futures, you will open a commodity account with them. In the meantime, once you have registered simply follow the directions of the commodity trading software and you are ready to begin.

What You Might Notice

If you put the cart before the horse and try to implement positions before you understand futures trading, you will be in for a surprise. The language of futures trading is different; there is terminology you need to learn, strategies that you won’t understand and even the trading software will probably be confusing. So before you try to begin commodities trading, go back to school and learn the terms, learn the techniques and learn the software where you are paper trading futures.

Is Paper Trading Futures Important?

In and of itself, paper trading futures is not important; it is merely a simulation of the things required to trade futures in the real world. What is important while paper trading futures is the approach you take; if you treat this like a game or don’t understand the importance of learning futures trading, you should seriously reconsider attempting to trade futures. This is a skill and the consequence is losing your money so don’t take paper trading futures lightly.

Conclusion

It is difficult to find another business opportunity where you can practice and learn for free. Take advantage of this unique opportunity and start paper trading futures today.

![]()

Futures Trading for Beginners – Getting Started

![]()

They say a journey of a thousand miles begins with the first step. This is true of futures trading for beginners as well. Even if you have investment experience you might not know the difference between stock trading and futures. Don’t get worried because that is the reason for this discussion. What is going to happen is that we will look at futures trading for beginners and give you some of the basics to get you started. If you have never been exposed to futures trading, it’s OK; the journey may be a thousand miles but we will take the first step together.

What Are Futures?

Futures trading is different from investing in the stock market or bonds since you don’t actually own anything. In futures trading, you are speculating on the future direction of the price in the commodity you are trading. This is different for beginners in futures trading; it is like a bet on the future price direction. The terms “buy” and “sell” merely indicate the direction you expect future prices will take. He or she must only deposit sufficient capital with a brokerage firm to insure that he will be able to pay the losses if his trades lose money.

Futures trading is a sort of insurance plan for those who are trading and investing. A farmer may sell futures on his wheat crop if he thinks the price will go down before the harvest; conversely, a bread manufacturer may buy futures if they think the price of wheat is going to rise before the harvest. Regardless of the price movement, both are guaranteed their price. The final component of the equation is the investor in futures trading who looks for changes in the futures markets and seeks to gain advantages by buying or selling at a profit.

What Is The Potential of Futures Trading?

Trading futures has the potential to be an incredible profit maker. It is said that Richard Dennis, a famed commodities trader, was able to parlay $1,600 of borrowed money into $200 million over ten years. While his results are truly extraordinary, not everyone can expect the level of successful trading he achieved, there is good news for every investor; you can make money in futures trading. You may only be a beginner trading futures, but you are savvy enough to recognize the potential in futures trading.

What Are Futures Markets?

The beginner in futures trading needs to understand that futures are not trading on the stock market. Some of the locations are well known like the Chicago Board of Trade, the New York Mercantile, the New York Cotton Exchange and the Chicago Mercantile Exchange. Some of the better known futures markets are:

- Agriculture – This is a broad, commonly traded futures which includes such things as wheat, soybean and corn futures.

- Currency Trading – Currency trading, also known as FOREX (foreign exchange) trading, involves buying and selling currency from many different countries such as the US dollar, the British pound and the Japanese yen.

- Interest Rate Futures – This market focuses on financial transactions, interest rates and bonds.

- Energy Futures – This market centers its attention on gas and oil futures.

- Foods – This sector includes items such as coffee, sugar and orange juice.

- Metals – This is one of the more popular and better known sectors. The typical commodities in metals are gold and silver.

What Do You Need To Do To Get Started?

There are several things you need to do as a beginner in futures trading:

- Start Learning – There is no substitute for education. Read books about futures trading, talk with others that trade futures and search the Internet for information about futures trading. Once you start investing your own money, you will be glad to understand futures trading.

- Create a Commodities Trading Plan – This is crucial. You need to outline your goals and objectives as well as your strategies in an unemotional manner. This way, when greed and fear interferes with your decision making process, you will have already decided your course of action.

- Select a Broker – This is a personal, but important part of the process. You can implement your own trades but you need someone to actually place the orders. Some full-service brokers offer more services and most Internet brokers offer lower commissions. Even though you’re a beginner in futures trading, define what you want from your broker and find someone who meets your needs.

- Use Japanese Candlesticks – This powerful commodity trading and charting system will help not only the beginner in futures trading but is valuable to the “expert” as well. Candlesticks will help you to find the trends in the market that most others miss.

Conclusion

Futures trading for beginners is nothing more than learning, defining your processes and sticking to your trading plan. This journey is no longer a thousand miles for you; you’ve already taken the first step so keep moving toward you goal!

Right-click on the link below and save target to your desktop, or to a file onto your computer. Once on your own computer, the recording may be opened with Windows Media Player, or QuickTime Player.

Stock Chat – Thursday 07/27/2011

Special presentation by Stephen Bigalow on Introduction to Trading Commodities

includes limited time offer on discounted Commodity Training Tutorials.

Selecting An Options Trading Advisor

Selecting an options trading advisor is an important step in preparing to trade options. Before we break down the different types of accounts, let’s talk with the beginners first. If you have experience investing in the stock market, you probably already know that you can trade options with you current account.

Selecting An Options Trading Advisor

For the beginner, this is a very important step. In fact, selecting an options trading advisor and creating a stock trading plan are the two most important things you can do prior to entering the market. The critical factors in selecting an options trading advisor are:

- Knowing Yourself – Be honest in evaluating your tendencies; are you a risk taker? Do you like to study and do research? Do you enjoy the idea of investment risk? Do you realize that you have more dollars than sense? You know the answers to questions like these; it is important that you understand your tendencies because there are options trading advisors for every personality type.

- Knowing The Available Advisors – Sounds difficult but once you have done a self-evaluation, you are well on your way to finding the right options trading advisor for you. Investment firms offer a number of different accounts types based on the needs you have.

What Are The Different Types of Accounts?

Trading accounts vary based of level of service, cost and available resources. The list below will give you an idea of the different types of accounts available:

- Discount Trade – This type of account is intended for the experienced trader; you will not have the security of an options trading advisor. Because you will be calling your directly to the order desk or the floor, you will receive nearly instantaneous placing of orders. The commissions for discount trades are low but little is available as far as research or recommendations from an options trading advisor.

- Internet Trade – Is it important to you to talk with an options trading advisor? If not, Internet trade may be the way for you to go. You can place trades, cancel replace orders, view your account status and get real time quotes, all with the click of your mouse. Since you are handling your own account, commissions are low, ranging from $10 to $40 per transaction. Like discount trades, this isn’t recommended as the best alternative for beginners because there is little support beyond implementing positions.

- Broker Assisted Accounts – If you have some experience in the stock market but still need the guidance of an options trading advisor, this is an excellent option. In addition a beginner who is extremely disciplined and dedicated to learning might be interested in this level of support. Options trading advisors are available to help you with information, advice, placing orders and charting. Prices are in the $50 range per transaction which falls directly between discount trades and full service brokers.

- Full Service Recommendations – With this type of options trading advisor you will likely be on a first-name basis, since he or she will probably be assigned to your account. Such advisors will be able to help you form an investment philosophy as well as placing trades, offering investment advice and reviewing your individual trades. This is the most expensive option but the best for the beginner or the investor that doesn’t want to spend the time to research and chart potential positions. Commissions for a service such as this range upwards of $100.

- Day Traders – Do you want to participate in the lightening quick trading of day trading? If you want to regularly trade in and out of positions on the same day? If you are committed to turning your positions everyday, this is a good account for you. Commissions are reasonable and range from $10 to $25.

Conclusion

Along with the trading rules in your stock trading plan, selecting an options trading advisor and trading account will likely be your most important decisions in the stock market. Analyze your personal approach and tendencies and select your options trading advisor based on your needs.

2011 Stock Market Holidays

| 2011 Stock Market Holidays | Date |

| Martin Luther King, Jr. Day | January 17,2011 |

| Washington’s Birthday/Presidents’ Day | February 21,2011 |

| Good Friday | April 22,2011 |

| Memorial Day | May 30,2011 |

| Independence Day | July 4, 2011 |

| Labor Day | September 5, 2011 |

| Thanksgiving Day** | November 24, 2011 |

| Christmas | December 26, 2011 |

| **The NYSE Trading Floor closes early (1PM ET) on Friday November 25,2011 (The day after thanksgiving) |

Remember, the professional money managers often vacation around scheduled exchange holidays.

They may also close positions several days before, causing lighter volume around the stock market holidays.

Unpublished Special – Not Found anywhere else in our website!

For a limited time we are offering an exceptional opportunity to receive a 2-Week Free Trial Membership to The Candlestick Forum.

To participate – simply send an email to Abraham@candlestickforum.com with the subject line: 2-Week Free Trial Membership. You will receive an email with full instructions to join as our Guest and access Free Downloads valued over $335 in educational tutorials! (no credit card information will be requested, you are our Guest)

Look at Membership Benefits with over $335 worth of immediate free downloads to

Trade with Candlestick Confidence

Candlestick Pattern Formations

Japanese Candlestick charting dramatically increases the information conveyed to the visual analysis. Each candlestick trading formation or series of formations can clearly illustrate the change of investor sentiment. This process is not apparent in standard bar chart interpretation. Each candle formation has a unique name. Some have Japanese names, others have English names.

Single candles are often referred to as YIN and YANG lines. These terms are actually Chinese, but are used by Western analysts to account for opposites; in/out, up/down, and over/under. INN and YOH are the Japanese equivalents. YIN is bearish. YANG is bullish. There are nine basic YIN and YANG lines in Candlestick analysis. These are expanded to fifteen to cover all possibilities clearly. The combination of most patterns can be reduced to one of these candlestick patterns.

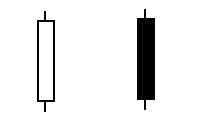

Long days

A long day represents a large price move from open to close when candlestick charting. Long represents the length of the candle body. What qualifies a candle body to be considered long? That is a question that has to be answered relative to the chart being analyzed. The recent price action of a stock will determine whether a “long” candle has been formed. Analysis of the previous two or three weeks of trading should be a current representative sample of the price action.

Short Days

Short days can be interpreted by the same analytical process of the long candles on candlestick charts. There are a large percentage of the trading days that do not fall into either of these two categories.

Maruboza

In Japanese chart analysis, Marubozu means close cropped or close-cut. Bald or Shaven Head are more commonly used in candlestick analysis. It’s meaning reflects the fact that there are no shadows extending from either end of the body.

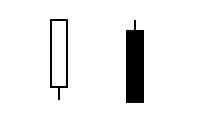

White Maruboza

The White Marubozu is a long white body with no shadows on either end. This is an extremely strong pattern used in stock analysis. Consider how it is formed. It opens on the low and immediately heads up. It continues upward until it closes, on its high. Counter to the Black Marubozu, it is often the first part of a bullish continuation pattern or bearish reversal pattern. It is called a Major Yang or Marubozu of Yang.

Black Marubozu

A long black body with no shadows at either end used in Japanese Candlesticks is known as a Black Marubozu. It is considered a weak indicator. It is often identified in a bearish continuation or bullish reversal pattern, especially if it occurs during a downtrend. A long black candle could represent the final sell off, making it an “alert” to a bullish reversal setting up. The Japanese often call it the Major Yin or Marubozu of Yin.

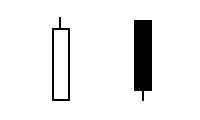

Closing Marubozu

A Closing Marubozu has no shadow at it’s closing end. A white body will not have a shadow at the top. A black body will not have a shadow at the bottom. In both cases, these are strong signals corresponding to the direction that they each represent.

Opening Marubozu

The Opening Marubozu has no shadows extending from the open price end of the body. A white body would not have a shadow at the bottom end , the black candle would not have a shadow at it’s top end. Though these are strong signals, they are not as strong as the Closing Marubozu.

Spinning Top

Spinning Tops are depicted with small bodies relative to the shadows. This demonstrates some indecision on the part of the bulls and the bears. They are considered neutral when trading in a sideways market. However, in a trending or oscillating market, a relatively good rule of thumb is that the next days trading will probably move in the direction of the opening price. The size of the shadow is not as important as the size of the body for forming a Spinning Top.

Doji

The Doji is one of the most important signals in candlestick analysis. It is formed when the open and the close are the same or very near the same. The lengths of the shadows can vary. The longer the shadows are, the more significance the Doji becomes. More will be explained about the Doji in the next few pages. ALWAYS pay attention to the Doji.

The dimension of knowing what the formations signify magnifies the potential for profits. The bodies, unlike the bars of bar charts, reveal an immense amount of information.

On to Candlestick Research Go To Products on Trading Candlestick Patterns