A Bear Call Spread is a stock market strategy employed when the market is extremely volatile and moderately bearish. Because of the erratic movements in a bear market, an investor will, in many instances, look to make moves that are profitable, yet hold low risk. The Bear Call Spread, also known as the Bear Credit Spread, is just such a technique that successful traders use in times such as these.

The stock option trading strategy for a Bear Call Spread is as follows. A trader sells a call option at one strike price and buys a call on the same asset which is further out-of-the-money (at a higher strike price). In most cases, both options will have the same expiration date. The profit and loss strategy for a Bear Call Spread is quite similar to a Bear Put Spread; however with this technique; the trader immediately receives a net premium when establishing the position. In a Bear Put Spread, the premium is paid when the position is established. Because of this difference, the investor already has money in hand at the inception of the Bear Call Spread.

The Bear Call Spread is lower risk than the Bear Put Spread; however, the profit potential is lessened as well. In a Bear Call Spread, the risk is minimized because the investor purchases lower priced calls that are protection if the price goes up significantly. Conversely, in a Bear Call Spread, profit potential is limited to the premium collected for the calls sold, less the cost of the premium paid for the calls that were purchased. As the name implies, this strategy is used in a bearish market, unlike the Bull Call Spread, which is employed when the market has become bullish.

A Bear Call Spread is a perfect example of successful trading. When an investor, through stock market technical analysis, realizes the presence of a bear market, it is imperative to modify the stock investing system. A bull market brings more opportunities for profitable trading; a bear market typically moves a trader into a more conservative approach of minimizing risks and finding trades that, while lucrative, are less risky. A Bear Call Spread is a perfect example of such a conservative move to find profits.

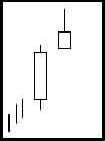

During a bearish period of trading, it is necessary for the investor to follow his, or her, stock trading plan. This requires solid stock technical analysis, stop loss strategies, and utilization of a stock trading system such as Japanese Candlesticks. This system, which has more than 200 years of success, helps the investor to evaluate the data obtained through technical analysis. Japanese Candlesticks is invaluable, especially in bearish times, as it assists the trader in drawing conclusions about the movements of the market.

A Bear Call Spread is one technique that an investor can use to find profits during an especially bearish market or a market experiencing volatility. Through technical analysis tools and learning how to read stock charts, a trader can focus on making money even when the market wants to take money from its investors.