Trading commodities online has gained popularity for many investors in recent years. Not only are trades executed quicker than when using a real live broker, but commissions are lower as well. While there are many benefits to trading commodities online, investors must also be aware of the hidden dangers with using this method. Both the advantages and disadvantages of trading commodities without the use of a full-service broker will be discussed in today’s article.

Online commodities trading does provide lower commissions than if going through a live full-service commodities broker making it more cost effective to practice multiple strategies at once. Traders are able to practice more sophisticated trades by potentially cutting the cost by about one hundred dollars per trade! For example, commodity trading can be done for fewer than ten dollars per round-turn with most online brokers.

Trading commodities online also allows instant trading without having to contact a live broker to place your orders. Almost everything you could possibly need to trade commodities is available through an online commodity trading account including commodity trading charts, commodity news, and technical analysis programs.

Commodity investing online also has its disadvantages that investors should be forewarned about. There is the potential to overtrade and this has become an increasing problem with the increased use of online trading. Due to the ease of which one can place trades online, this has led to undisciplined and impulsive trading. Additionally, due to lower commission rates, inexperienced investors will get often place trades that they normally wouldn’t, quickly finding themselves in a financial predicament. For some investors, the ease of trading leads to a false feeling of control and independence.

Trading commodities online is also dangerous for new investors who may need a mentor. Online brokers are often discount brokers that do not provide any advice to the new investor, but merely places the trades requested of them. This is great for investors who know what they are doing, and have achieved success in the commodities markets, but for the new investor, it may not be such a great thing. Many new traders make foolish mistakes that they wouldn’t have otherwise made if they had the assistance of a full-service broker. Many feel that the education received from a live broker is well worth the cost for new investors. Live broker offer more value to newer investors than they do to more experienced investors. Many investors suggest starting off with a full-service broker until you attaint the level of knowledge and discipline required to trade successfully. Regardless of which type of broker you decide to utilize, it is imperative that you at least have a mentor to which you can learn from and go to for help.

Many commodities brokers will give you a free trial period in order to test their services. Choosing your commodity broker is one of the most important decisions that you will make in your trading career, so be sure that you do your research. Finding a reputable broker that not only meets your needs but that compensates for your shortcomings will lead you to successful trading when trading commodities online.

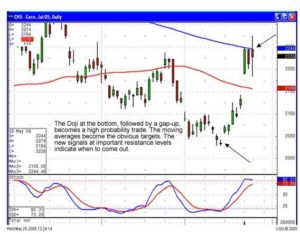

When do people sell? They panic sell at the bottom! The identification of the Dumpling Top pattern allowed for being in the right strategy at the right time. Knowing the results that should occur after a candlestick pattern allows an investor to take advantage of big price moves. That can occur in two different methods. As the market was selling off, having funds in short positions produced significant profits. For those that do not like to go short, sitting in cash was the proper strategy. Sitting in cash has a powerful outcome when used properly. Knowing that the markets are in a severe decline has an obvious ramification. There is panic selling coming into this market. That is probably enhanced with margin calls. The basic premise of candlestick analysis is having a graphic depiction of what is going on in investor sentiment. The charts will show when panic selling is occurring. That has been witnessed for the past three trading days as this downtrend accelerates. There are also some simple signs for when the bottom has finally arrived.

DOW

The futures continued to trade lower after the close today. This was after the Dow was down almost 700 points. The NASDAQ clearly negated the Inverted Hammer signal with a 95 point drop. What would indicate final capitulation? A gap down on the open tomorrow. A simple rule of thumb, when you see a gap down in an oversold condition, start watching for a Candlestick buy signal. Which stocks should be bought when a potential reversal is in the making? There are simple scanning techniques that show which stocks are experiencing bullish participation even with the market plunging. The visual analysis of this relative strength allows investors to be prepared to enter stock positions that have good upside potential when the reversal occurs.

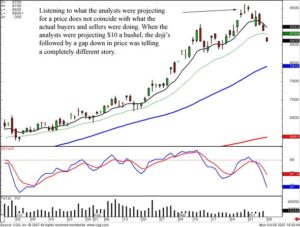

CNH

What type of reversal usually occurs after a severe market plunge? A very strong upsurge! Why? Because when it becomes obvious to the smart money that the markets are severely oversold, the funds that have been accumulated from selling at higher levels are waiting for the capitulation day.

This is where huge profits can be made. Look for a gap down. If that occurs and the selling continues, go to your one minute and five-minute charts and start watching to see when the ‘churning’ begins. The candlestick signals will appear when the buyers and sellers finally find a level where they have reached equilibrium. Repeat – this is where huge profits can be made. Once the buyers see that a bottom has been made, the panic buying will start. This can produce rates of return of 20%, 40%, 100% in just a very short period of time. Watch for candlestick reversal signals or the preparation of a candlestick signals set up.

Chat room tonight – 8 PM ET- everybody is welcome. Click here for instructions. This is where scanning for the possible high profit trades becomes immensely important. The stocks that are getting obliterated because of margin calls and panic selling will be the ones that drop dramatically fast and come back up dramatically fast.

Good investing,

The Candlestick Forum Team

This Week’s Special

Trend Analysis 25% OFF at Checkout

Subscriber Special – Only 10 sets remaining

Trading with the Confidence of Candlesticks

Website special reflects current newsletter. If you are reading an archived newsletter you will be directed to Current Website Special.