Sell Stock and Buy Stock with Technical Analysis

There is so much to technical analysis that it takes many investors quite some time before they have a full understanding of it concepts and terminology. Once understood, however it can lead to successful trading and great profit potential. In today’s article we discuss important steps that every investor should take if looking to sell stock or buy stock using stock technical analysis.

Keep it Simple

You may become overwhelmed at the number of technical indicators available to investors to use when short term stock trading. You should have an understanding of the majority of them however you should not use all of them when you are trying to trade. You should use two or three in conjunction with one another. Some of the most popular technical indicators include the moving average, candlestick patterns, as well as support and resistance levels.

Back-Test Technical Indicators

Investors should back-test their technical indicators against historical data. You should do an ample number of tests in order to develop a trading system that works for you.

Paper Trade

Stock traders should practice paper trading before trading with real money. Investors should sell stock and buy stock using their trading plan and technical indicators on paper first in order to ensure that they have a plan for success in place. Online paper trading is very popular among investors these days. Just be sure that you don’t develop a fear for stock trading with real money. You will need to enter the market at some point! You will also need to work out the kinks with our trading plan in order to tweak it so it works to its full potential.

Stop Loss Orders

Just as you should know your entry points, you also need to set your exit strategies. Investors use stop loss orders in order to do this. This prevents the investor from holding onto a losing trade for too long with the hopes that it will reverse. While you still lose, you are limiting your losses significantly through understanding and implementing stop loss strategies. You must however be sure that you practice discipline and follow your strategy when you sell stock.

Many investors have found that technical analysis tools are extremely helpful when investing in the stock market. Keep in mind many investors opt to utilize the tools associated with fundamental analysis in order to practice long term investing. You can do both if you would like. It really depends on your philosophy and what you feel comfortable doing.

Market Direction

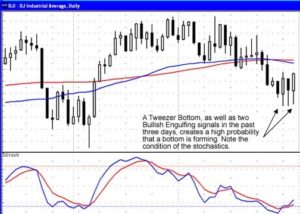

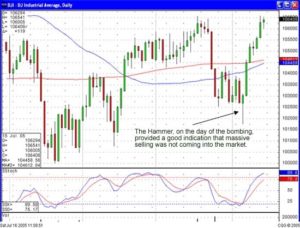

Let the market tell you what the market is going to do! This is professed by the Japanese Rice traders. It may seem like a very simplistic statement but it has some very powerful consequences. As observed in the Dow chart and the NASDAQ chart, the recent pullback looked exactly like the pullback of mid August. After the pullback, there were a couple of indecisive trading days. For the candlestick investor, this provides valuable information. One of two things was going to happen. Had the markets traded lower after those indecisive trading days, breaching the potential formation of a trend channel, it would be obvious the bears were in control.

As was witnessed, after the indecisive trading days, the small Spinning Top followed by a small Bullish Engulfing signal, the trend started moving back up. This made for a situation where profits could confidently be made. The positive trading of Thursday, Friday, and today confirmed the upward trading channel was still the predominant analytical factor. Having that knowledge, made easier to see with the candlestick signals, alerted the candlestick investor to close out short positions and build up the long positions of the portfolio. The visual aspects of the signals and the trend makes for easier and more decisive decisions.

DOW

The pullback of last week appears to be profit taking. This short-term selling atmosphere, prior to the last three days, has created Jay hook pattern’s. This now allows for the exploitation of the next price move. Knowing what a Jay hook pattern foretells allows an investor to pinpoint where the most powerful price moves may be occurring. As demonstrated in the XIDE chart, the strong price move was followed by a pullback and now the new buying can be witnessed.

XIDE

Knowing the correlation between the first wave and the third wave, an investor to develop the appropriate investment strategy to maximize the profits from the potential next move. This could either be buying stocks or buying options strategies. Understanding what a pattern will produce creates more than one advantage for the investor. It not only identifies the appropriate time to be reestablishing a position, it identifies which price moves should have more strength than a conventional price move. Wave three can be measured based upon the magnitude of wave one.

The Scoop pattern also is providing some big price move opportunities. Placing positions in the portfolio that are the result of a price pattern identification creates a much stronger probability that at least one, if not more, positions in the portfolio might have the potential to provide a huge price move. That potential can be seen in the ASH chart and in the NUAN chart.

ASH

NUAN

Consistently adding positions to the portfolio that have high probability results produces a self disciplined trading program. It helps an investor to make decisions that constantly improve the probabilities of being in the right place at the right time. When the force of a trend can be analyzed utilizing candlestick signals, an additional benefit is the ‘protection’ to the downside. Even during a strong reversal in the overall market trend, the charts that had shown inordinant strength before the reversal will usually have enough ‘carry through’ to allow the liquidation of that position with much less loss compared to other positions.

The added strength of a candlestick chart pattern makes options strategies an extremely viable trading platform. The direction of a price movement can be well defined with candlestick signals. Those price moves become much better leveraged when applying simple option strategies. Candlestick analysis is merely the identification of a price trend based upon the signals created by investor sentiment. Profitable investing is the result of taking advantage of those price trends.

Good investing,

The Candlestick Forum Team

Options Trading with Stephen Bigalow