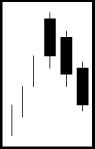

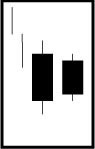

The best commodities to trade will depend upon a variety of circumstances, always including market timing. Commodity groups include energy, food and fiber, grains, interest rates, meats, metals, and stock indices. In all of these commodities markets there are factors that determine whether commodity prices will rise or fall when trading commodity futures. For traders with a great deal of expertise in a given commodity the best commodities to trade may be the most variable as these will be where the most profit potential lies. For the new comer to commodity trading the best commodities to trade may be those with less market volatility and, therefore, less risk of substantial loss. As with all trading it is wise to learn the basics first. Commodity and futures training is a good place to start. Learning the use of Candlestick charting techniques will help the beginning, and seasoned, trader to profit by anticipating price movement in commodities.

Often times commodity trading is trend trading. In the arena of traders there are followers of long term trends and short term trends. The longer the trend the more important it is to do fundamental analysis of the commodity involved. The shorter the trend the more important it is to do technical analysis. In all commodities trading fundamental and technical analysis have their places. For example, a trader who is expecting a long term rise in prices of corn futures will still want use tools such as Candlestick pattern formations to watch daily futures price movement in order to get the best purchase price even though he or she may be holding futures contracts for months or years. In trading commodities it is essential to know when large price movements usually occur. In trading agricultural commodities, such as live cattle commodity trading, a severe winter on the North American Great Plains may result in the deaths of many cattle. This will drive the price of beef up. An astute trader may see a weather map of a severe storm passing over Nebraska and Iowa and anticipate a drop in June live cattle futures.

Just as there is reason for diversifying a stock portfolio there can be reasons to diversify when trading futures on commodities. Although the possible return on investment in just trading interest rates or gold futures may be inviting, hedging in the form of trading a balanced portfolio of commodities may be safer and more profitable in the long run. Factors to consider when choosing the best commodities to trade are market liquidity as well as fundamental trends. For interest rates and currencies the trader will need insight into economics and politics as well as the banking systems of the countries involved. Trading oil futures, energy credits, natural gas futures and the like also require a sense of the economy as a recession can decrease demand substantially. Trading precious metals futures also has a lot to do with the economy and monetary policy. Many who trade in gold believe that the US and other nations will not be able to avoid inflation over time and, as such, habitually trade gold futures in the belief that the precious metal can only go up over time. A view of history will show that this is not the case as when gold prices plummeted in the 1980’s. In the end the best commodities to trade are the ones the trader knows the most about and is willing to follow closely enough to anticipate the market.

Market Direction

No Market Direction today due to traveling.

Chat session tonight 8 PM ET – Tina Logan will be presenting this Thursday June 10th.

The Candlestick Forum Team

July 2010

2-Day- Training Webinars

Candlestick Technical Analysis Webinar – July 10 & 11

Options Training Webinar – July 31st & August 1st

Trend Analysis- 50% OFF

Website special reflects current newsletter. If you are reading an archived newsletter you will be directed to Current Website Special.